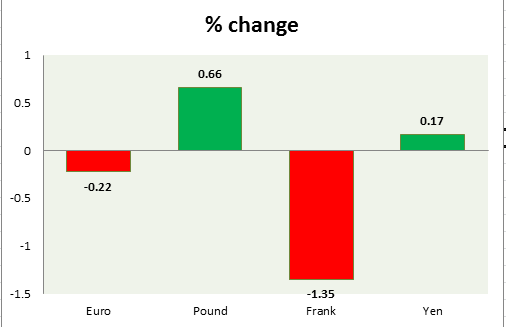

Dollar performance mixed against the majors (EUR, GBP, JPY, & CHF) so far this week. A chart and table is attached for explanation.

- Euro continued range trade. Better news headlines & a stable view by Janet Yellen have helped it to snap back from the range low. Today non EU trade balance data was published which showed it narrowed in Italy to € 0.24 billion. Mario Draghi's speech is focus today. Currently trading at 1.134. Immediate Support lies at 1.127 & Resistance 1.147.

- Pound remained the best performing currency and taken out its resistance at 1.547 and economic data remain mixed. BOE governors' maintained position in recent speech, mortgage approval remains stable at 36.4K. Currently trading at 1.55. Immediate Support lies at 1.535 & Resistance 1.56.

- Yen continued whipsaw movement but covered it's loss against dollar, benefiting from the comments of governor Yellen and safe haven flow. Currently trading at 118.8. Immediate Support lies at 118.2 & Resistance 120.5.

- Franc, still the worst performer this week, trying to find ground after January's SNB blink on EUR/CHF floor. Today UBS consumption indicator was published that deteriorated to 1.24 from previous 1.42. Currently trading at 0.95. Immediate Support lies at 0.937 & Resistance 0.954.

|

Euro |

-0.22% |

|

Pound |

0.66% |

|

Frank |

-1.35% |

|

Yen |

0.17% |

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary