Dollar index trading at 102.88 (+0.06%)

Strength meter (today so far) – Euro -0.14%, Franc -0.05%, Yen +0.23%, GBP -0.54%

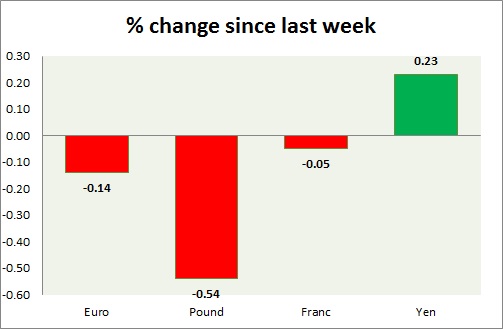

Strength meter (since last week) – Euro -0.14%, Franc -0.05%, Yen +0.23%, GBP -0.54%

EUR/USD –

Trading at 1.043

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support

- Long term – 1.01, Medium term – 1.032, Short term – 1.032

Resistance –

- Long term – 1.11, Medium term – 1.087, Short term – 1.067

Economic release today –

- Labor cost in the third quarter rose by 1.5 percent.

- Construction output rose by 0.8 percent in October, up 2.2 percent from a year ago.

Commentary –

- The euro is likely to slide further towards parity. Active call – Sell EUR/USD at 1.116 with stop loss at 1.15 and target at 1.01. stop loss revised to 1.13

GBP/USD –

Trading at 1.241

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support –

- Long term – 1.16, Medium term – 1.2, Short term – 1.2

Resistance –

- Long term – 1.32, Medium term – 1.27, Short term – 1.27

Economic release today –

- NIL

Commentary –

- The selloffs in pound likely to extend towards $1.21 in the short run. We expect the pound to reach parity.

USD/JPY –

Trading at 117.3

Trend meter –

- Long term – Sell, Medium term – Range/ Buy, Short term – Buy

Support –

- Long term – 98, Medium term – 105, Short term – 112

Resistance –

- Long term – 121, Medium term – 120, Short term – 119

Economic release today –

- NIL

Commentary –

- After long painstaking days, the yen is finally having some good time. The best performer of the day.

USD/CHF –

Trading at 1.026

Trend meter –

- Long term – Buy, Medium term – Range, Short term – Range/Buy

Support –

- Long term – 0.95, Medium term – 0.95, Short term – 1

Resistance –

- Long term – 1.08, Medium term – 1.037, Short term – 1.037

Economic release today –

- NIL

Commentary –

- Franc is still testing the last bottom around 1.03 area. Franc might decline to 1.08 per dollar. Target extended o 1.14

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed