Dollar index trading at 103 (-0.10%)

Strength meter (today so far) – Euro +0.21%, Franc -0.02%, Yen +0.05%, GBP +0.14%

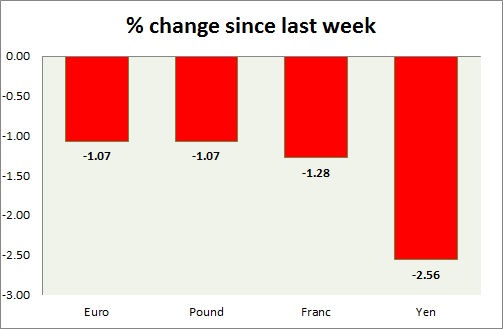

Strength meter (since last week) – Euro -1.07%, Franc -1.28%, Yen -2.56%, GBP -1.07%

EUR/USD –

Trading at 1.044

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support

- Long term – 1.01, Medium term – 1.032, Short term – 1.032

Resistance –

- Long term – 1.11, Medium term – 1.087, Short term – 1.067

Economic release today –

- Trade balance for October came at €19.7 billion.

- Consumer price index by 0.1 percent in November, up 0.6 percent from a year ago.

Commentary –

- The euro has declined to the lowest level since 2003. Active call – Sell EUR/USD at 1.116 with stop loss at 1.15 and target at 1.01. stop loss revised to 1.13

GBP/USD –

Trading at 1.243

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support –

- Long term – 1.16, Medium term – 1.2, Short term – 1.2

Resistance –

- Long term – 1.32, Medium term – 1.27, Short term – 1.27

Economic release today –

- NIL

Commentary –

- The selloffs in pound likely to extend towards $1.21 in the short run. We expect the pound to reach parity.

USD/JPY –

Trading at 118.2

Trend meter –

- Long term – Sell, Medium term – Range/ Buy, Short term – Buy

Support –

- Long term – 91, Medium term – 98, Short term – 105

Resistance –

- Long term – 121, Medium term – 120, Short term – 119

Economic release today –

- NIL

Commentary –

- The yen remains the weakest performer of the week.

USD/CHF –

Trading at 1.03

Trend meter –

- Long term – Buy, Medium term – Range, Short term – Range/Buy

Support –

- Long term – 0.95, Medium term – 0.95, Short term – 1

Resistance –

- Long term – 1.08, Medium term – 1.037, Short term – 1.037

Economic release today –

- NIL

Commentary –

- Franc is still testing the last bottom around 1.03 area. Franc might decline to 1.08 per dollar.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed