Dollar index trading at 100.53 (-0.8%)

Strength meter (today so far) – Euro +0.44%, Franc -0.08%, Yen -0.84%, GBP +0.08%

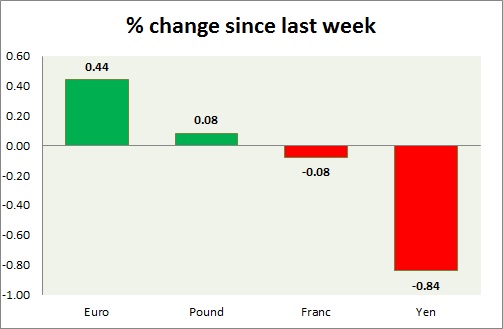

Strength meter (since last week) – Euro +0.44%, Franc -0.08%, Yen -0.84%, GBP +0.08%

EUR/USD –

Trading at 1.07

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support

- Long term – 1.01, Medium term – 1.032, Short term – 1.054

Resistance –

- Long term – 1.13, Medium term – 1.11, Short term – 1.09

Economic release today –

- Markit services PMI came at 53.8 in November.

- Sentix investor confidence declined to 10 in December.

- Retail sales rose by 1.1 percent in October, up 2.4 percent from a year ago.

Commentary –

- The euro rose sharply recovering from initial decline triggered by the resignation of Italy’s Prime Minister Matteo Renzi after referendum losses as Italian banks’ trouble could end with nationalization. Active call – Sell EUR/USD at 1.116 with stop loss at 1.15 and target at 1.01. stop loss revised to 1.13

GBP/USD –

Trading at 1.273

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support –

- Long term – 1.16, Medium term – 1.2, Short term – 1.2

Resistance –

- Long term – 1.32, Medium term – 1.27, Short term – 1.27

Economic release today –

- Services PMI came at 55.2 in November.

Commentary –

- The pound is up on weaker dollar. We expect the pound to reach parity.

USD/JPY –

Trading at 114.3

Trend meter –

- Long term – Sell, Medium term – Range/ Buy, Short term – Buy

Support –

- Long term – 91, Medium term – 98, Short term – 105

Resistance –

- Long term – 119, Medium term – 115, Short term – 115

Economic release today –

- NIL

Commentary –

- The yen is testing key support around 115 area.

USD/CHF –

Trading at 1.01

Trend meter –

- Long term – Buy, Medium term – Range, Short term – Range/Buy

Support –

- Long term – 0.9, Medium term – 0.927, Short term – 0.95

Resistance –

- Long term – 1.08, Medium term – 1.037, Short term – 1.037

Economic release today –

- NIL

Commentary –

- Franc is relatively worse performer compared to the euro. Franc might decline to 1.08 per dollar.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed