Dollar index trading at 97.03 (+0.18%).

Strength meter (today so far) - Euro -0.16%, Franc -0.09%, Yen -0.27%, GBP -0.11%

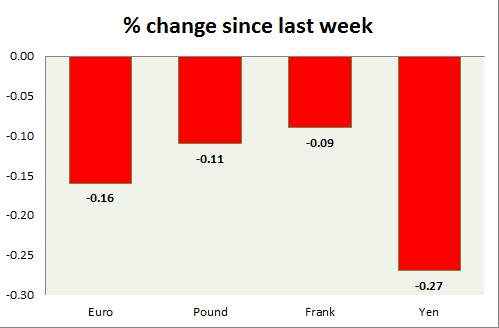

Strength meter (since last week) - Euro -0.16%, Franc -0.09%, Yen -0.27%, GBP -0.11%

EUR/USD -

Trading at 1.086

Trend meter -

- Long term - Sell, Medium term - Sell, Short term - Range/Buy support

Support -

- Long term - 1.048-1.036, Medium term - 1.048-1.036, Short term - 1.068-1.063

Resistance -

- Long term - 1.1035-1.11, Medium term - 1.102-1.11, Short term - 1.102-1.105

Economic release today -

- COT report shows speculators increased further short position for the week ending April 21 by -523 million to total -28.8 billion.

Commentary -

- Euro is hovering below 1.09 to start of the week. Price has broken short term resistance around 1.083 and further appreciation is likely. FOMC remains in focus.

GBP/USD -

Trading at 1.517

Trend meter -

- Long term - Range/Sell, Medium term - Sell, Short term - Range/Buy

Support -

- Long term - 1.425-1.417, Medium term - 1.462-1.455, Short term - 1.487-1,483

Resistance -

- Long term - 1.553-1.56, Medium term - 1.516-1.52, Short term - 1.516-1.52

Economic release today -

- Speculators rolled back short positions in pound by 599 million to -2.73 billion.

- CBI industrial orders improved to 1 from 0 but came much lower than expected at 4

Commentary -

- Pound was the best performer last week, focus is on tomorrow's GDP estimate and FOMC on Wednesday.

USD/JPY -

Trading at 119.3

Trend meter -

- Long term - Buy, Medium term - Range/Sell, Short term - Range/Buy support/Sell resistance

Support -

- Long term - 113.7-112.9, Medium term - 115.7-115, Short term - 118.5-118

Resistance -

- Long term - 125, Medium term - 122, Short term - 122. Immediate - 120.8

Economic release today -

- Speculators further reduced short position in Yen by 906 million to -1.5 billion.

Commentary -

- Yen is the worst performer today, might remain so rest of the week.

USD/CHF -

Trading at 0.955

Trend meter -

- Long term - Buy, Medium term - Sell/Range, Short term - Range/Sell resistance

Support -

- Long term - 0.88, Medium term - 0.937, Short term - 0.945, Immediate - 0.95

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.984-0.987, Immediate - 0.966-0.972

Economic release today -

- Speculators increased bullish position by 22 million to 44 million.

Commentary -

- This week would be very crucial for Franc bears as they have defended 0.95 level very well for last 5 weeks, however FOMC might provide big break for Franc bulls.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary