Dollar index trading at 94.4 (-0.14%)

Strength meter (today so far) – Euro +0.07%, Franc +0.18%, Yen +0.15%, GBP +0.43%

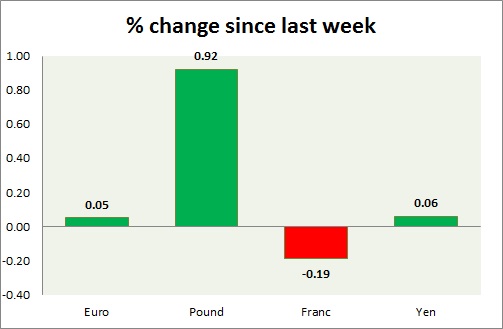

Strength meter (since last week) – Euro +0.05%, Franc -0.19%, Yen +0.06%, GBP +0.92%

EUR/USD –

Trading at 1.132

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support

- Long term – 1.06, Medium term – 1.08, Short term – 1.09

Resistance –

- Long term – 1.16, Medium term – 1.143, Short term – 1.132

Economic release today –

- Markit manufacturing PMI declined to 51.8 in August from 52.

Commentary –

- Euro is up this week on weaker dollar. Active call – Sell EUR/USD at 1.116 with stop loss at 1.15 and target at 1.01. However, in the short run, Euro might ride higher.

GBP/USD –

Trading at 1.318

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support –

- Long term – 1.2, Medium term – 1.27, Short term – 1.29

Resistance –

- Long term – 1.39, Medium term – 1.35, Short term – 1.34

Economic release today –

- CB Industrial trend survey came better than expected at -5 but marginally worst than prior -4.

Commentary –

- The pound is the best performer of the day. The best performer of the week too. We expect the pound to reach parity.

USD/JPY –

Trading at 100.1

Trend meter –

- Long term – Sell, Medium term – Range/ Sell, Short term – Sell

Support –

- Long term – 91, Medium term – 98, Short term – 98

Resistance –

- Long term – 111, Medium term – 107, Short term – 107

Economic release today –

- NIL

Commentary –

- The yen is hovering around 100 area. Active call – Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5. All targets reached, new target 90 added. Yen may retrace to 111 per dollar if BOJ intervenes.

USD/CHF –

Trading at 0.961

Trend meter –

- Long term – Buy, Medium term – Range, Short term – Range/Sell

Support –

- Long term – 0.9, Medium term – 0.927, Short term – 0.95

Resistance –

- Long term – 1.037, Medium term – 1.01, Short term – 0.994

Economic release today –

- Trade balance in July declined to 2.93 billion from 3.51 billion in June.

Commentary –

- Franc is down this week. We expect Franc to strengthen against Dollar to as high as 0.86 area in the medium term.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX