Dollar index trading at 97 (+0.46%)

Strength meter (today so far) – Euro -0.33%, Franc -0.30%, Yen -0.05%, GBP -0.91%

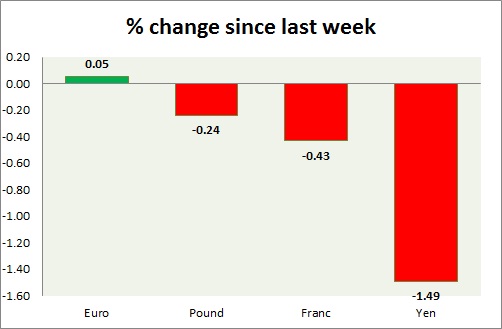

Strength meter (since last week) – Euro +0.05%, Franc -0.43%, Yen -1.49%, GBP -0.24%

EUR/USD –

Trading at 1.103

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support

- Long term – 1.08, Medium term – 1.10, Short term – 1.10

Resistance –

- Long term – 1.16, Medium term – 1.145, Short term – 1.12

Economic release today –

- Construction output decline -0.8 percent in June from a year ago.

- Zew survey economic sentiment declined sharply to -14.7 from 20.2

Commentary –

- Euro is down as data suggests Brexit referendum has hit sentiments. Active call – Sell EUR/USD at 1.116 with stop loss at 1.15 and target at 1.01

GBP/USD –

Trading at 1.314

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support –

- Long term – 1.2, Medium term – 1.25, Short term – 1.25

Resistance –

- Long term – 1.5, Medium term – 1.38, Short term – 1.35

Economic release today –

- RPI rose 1.6 percent y/y in June.

- PPI down -0.4 percent y/y in June.

- CPI up 0.5 percent y/y in June.

- Core CPI up 1.4 percent.

- House price index flat at 8.1 percent growth.

Commentary –

- Pound is worst performer of the day as concern over higher inflation grows. We expect the pound to reach parity.

USD/JPY –

Trading at 106.2

Trend meter –

- Long term – Sell, Medium term – Range/ Sell, Short term – Sell

Support –

- Long term – 91, Medium term – 98, Short term – 100

Resistance –

- Long term – 111, Medium term – 107, Short term – 107

Economic release today –

- NIL

Commentary –

- Yen is worst performer of the week on speculation that BoJ will intervene in the market or release fresh stimulus. Active call – Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5. All targets reached, new target 90 added. Yen may retrace to 111 per dollar if BOJ intervenes.

USD/CHF –

Trading at 0.986

Trend meter –

- Long term – Buy, Medium term – Range, Short term – Range/Sell

Support –

- Long term – 0.9, Medium term – 0.927, Short term – 0.95

Resistance –

- Long term – 1.037, Medium term – 1.01, Short term – 0.994

Economic release today –

- NIL

Commentary –

- Franc is moving in line with Euro. We expect Franc to strengthen against Dollar to as high as 0.86 area in the medium term.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022