Dollar index trading at 96.59 (+0.25%)

Strength meter (today so far) – Euro +0.52%, Franc +0.32%, Yen -0.60%, GBP +1.31%

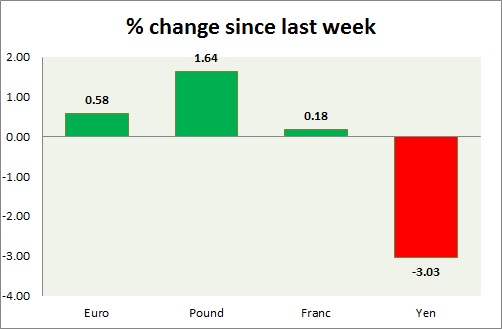

Strength meter (since last week) – Euro +0.58%, Franc +0.18%, Yen -3.03%, GBP +1.64%

EUR/USD –

Trading at 1.111

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support

- Long term – 1.08, Medium term – 1.10, Short term – 1.10

Resistance –

- Long term – 1.16, Medium term – 1.145, Short term – 1.12

Economic release today –

- NIL

Commentary –

- Euro is up from support around 1.1 area as dollar weakens. Active call – Sell EUR/USD at 1.116 with stop loss at 1.15 and target at 1.01

GBP/USD –

Trading at 1.315

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support –

- Long term – 1.2, Medium term – 1.25, Short term – 1.25

Resistance –

- Long term – 1.5, Medium term – 1.38, Short term – 1.35

Economic release today –

- Inflation report hearing has started at 9:00 GMT. Bank of England will release its quarterly bulletin at 11:00 GMT.

Commentary –

- Pound is best performer today as Theresa May became Britain’s next Prime Minister.. We expect the pound to reach parity.

USD/JPY –

Trading at 103.4

Trend meter –

- Long term – Sell, Medium term – Range/ Sell, Short term – Sell

Support –

- Long term – 91, Medium term – 98, Short term – 100

Resistance –

- Long term – 111, Medium term – 107, Short term – 103.5

Economic release today –

- NIL

Commentary –

- Yen is worst performer of the week on speculation that BoJ will intervene in the market. Active call – Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5. All targets reached, new target 90 added.

USD/CHF –

Trading at 0.981

Trend meter –

- Long term – Buy, Medium term – Range, Short term – Range/Sell

Support –

- Long term – 0.9, Medium term – 0.927, Short term – 0.95

Resistance –

- Long term – 1.037, Medium term – 1.01, Short term – 0.994

Economic release today –

- NIL

Commentary –

- Franc is moving in line with Euro. We expect Franc to strengthen against Dollar to as high as 0.86 area in the medium term.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed