Dollar index trading at 93.59 (-0.02%)

Strength meter (today so far) – Euro -0.06%, Franc +0.31%, Yen -0.81%, GBP +0.46%

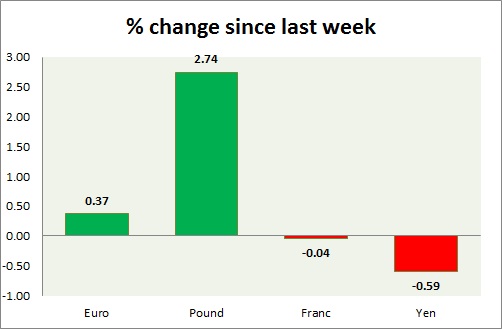

Strength meter (since last week) – Euro +0.37%, Franc -0.04%, Yen -0.59%, GBP +2.74%

EUR/USD –

Trading at 1.131

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Sell

Support

- Long term – 1.08, Medium term – 1.10, Short term – 1.10

Resistance –

- Long term – 1.2, Medium term – 1.16, Short term – 1.145

Economic release today –

- Zew survey economic sentiment grew to 20 from previous 16.8

Commentary –

- Euro is marginally down today, heading into Yellen’s testimony.

GBP/USD –

Trading at 1.474

Trend meter –

- Long term – Buy, Medium term – Buy, Short term – Range

Support –

- Long term – 1.4, Medium term – 1.4, Short term – 1.4

Resistance –

- Long term – 1.49, Medium term – 1.47, Short term – 1.47

Economic release today –

- Public sector net borrowing came at £9.14 billion.

Commentary –

- Pound is rising still and best performer today and this week.

USD/JPY –

Trading at 104.7

Trend meter –

- Long term – Sell, Medium term – Range/ Sell, Short term – Sell

Support –

- Long term – 98.5, Medium term – 102.8, Short term – 105

Resistance –

- Long term – 121, Medium term – 115, Short term – 111.2

Economic release today –

- All industry activity index grew 1.3 percent in April.

Commentary –

- Yen is the worst performer of the day as risk aversion fades with in camp gaining further momentum in the race. Active call – Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5 First three target reached, new target 90 added.

USD/CHF –

Trading at 0.959

Trend meter –

- Long term – Buy, Medium term – Range, Short term – Range/Sell

Support –

- Long term – 0.905, Medium term – 0.927, Short term – 0.95

Resistance –

- Long term – 1.037, Medium term – 1.01, Short term – 1

Economic release today –

- Trade balance came at 3.79 billion.

Commentary –

- Franc is much better performer today on safe haven bids and as exports grew more than expected. We expect Franc to strengthen against Dollar to as high as 0.9 area in the medium term.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed