Dollar index trading at 93.69 (-0.10%)

Strength meter (today so far) – Euro +0.55%, Franc -0.15%, Yen -0.51%, GBP +2.14%

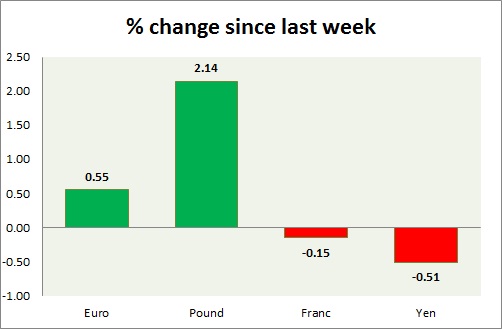

Strength meter (since last week) – Euro +0.55%, Franc -0.15%, Yen -0.51%, GBP +2.14%

EUR/USD –

Trading at 1.135

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Sell

Support

- Long term – 1.08, Medium term – 1.10, Short term – 1.10

Resistance –

- Long term – 1.2, Medium term – 1.16, Short term – 1.145

Economic release today –

- Construction output declined -0.4 percent in April, from a year back.

Commentary –

- Euro is up on risk affinity and the possibility of UK staying in the Union.

GBP/USD –

Trading at 1.465

Trend meter –

- Long term – Buy, Medium term – Buy, Short term – Range/Sell

Support –

- Long term – 1.4, Medium term – 1.4, Short term – 1.4

Resistance –

- Long term – 1.49, Medium term – 1.47, Short term – 1.47

Economic release today –

- NIL

Commentary –

- Pound rose sharply today as poll showed gains for the ‘remain’ camp.

USD/JPY –

Trading at 104.6

Trend meter –

- Long term – Sell, Medium term – Range/ Sell, Short term – Sell

Support –

- Long term – 98.5, Medium term – 102.8, Short term – 105

Resistance –

- Long term – 121, Medium term – 115, Short term – 111.2

Economic release today –

- NIL

Commentary –

- Yen is the worst performer of the day as risk aversion fades with in camp gaining momentum in the race. Active call – Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5 First three target reached, new target 90 added.

USD/CHF –

Trading at 0.96

Trend meter –

- Long term – Buy, Medium term – Range, Short term – Range/Sell

Support –

- Long term – 0.905, Medium term – 0.927, Short term – 0.95

Resistance –

- Long term – 1.037, Medium term – 1.01, Short term – 1

Economic release today –

- NIL

Commentary –

- Franc is down as risk affinity is the game of the day. We expect Franc to strengthen against Dollar to as high as 0.9 area in the medium term.