Dollar index trading at 94.32 (-0.27%)

Strength meter (today so far) – Euro -0.15%, Franc +0.35%, Yen +0.49%, GBP +0.04%

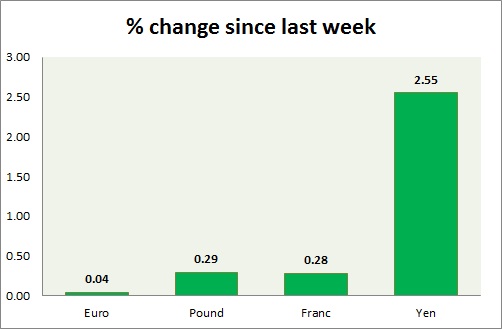

Strength meter (since last week) – Euro +0.04%, Franc +0.28%, Yen +2.55%, GBP +0.29%

EUR/USD –

Trading at 1.125

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Sell

Support

- Long term – 1.08, Medium term – 1.10, Short term – 1.10

Resistance –

- Long term – 1.2, Medium term – 1.16, Short term – 1.145

Economic release today –

- Current account surplus rose to €36.2 billion.

- Labour cost rose 1.7 percent.

Commentary –

- Euro has also started showing volatility due to association with British referendum.

GBP/USD –

Trading at 1.429

Trend meter –

- Long term – Buy, Medium term – Buy, Short term – Range/Sell

Support –

- Long term – 1.4, Medium term – 1.4, Short term – 1.4

Resistance –

- Long term – 1.49, Medium term – 1.47, Short term – 1.47

Economic release today –

- NIL

Commentary –

- Pound is continuing its high volatile trading.

USD/JPY –

Trading at 104.3

Trend meter –

- Long term – Sell, Medium term – Range/ Sell, Short term – Sell

Support –

- Long term – 98.5, Medium term – 102.8, Short term – 105

Resistance –

- Long term – 121, Medium term – 115, Short term – 111.2

Economic release today –

- NIL

Commentary –

- Yen is best performer this week due to risk aversion and as BOJ kept policy steady. Active call – Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5 First three target reached, new target 90 added.

USD/CHF –

Trading at 0.961

Trend meter –

- Long term – Buy, Medium term – Range, Short term – Range/Sell

Support –

- Long term – 0.905, Medium term – 0.927, Short term – 0.95

Resistance –

- Long term – 1.037, Medium term – 1.01, Short term – 1

Economic release today –

- NIL

Commentary –

- Franc is much better performer today thanks to risk aversion in the market. We expect Franc to strengthen against Dollar to as high as 0.9 area in the medium term.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX