Dollar index trading at 93.93 (-0.08%)

Strength meter (today so far) – Euro -0.15%, Franc +0.22%, Yen -0.20%, GBP +0.85%

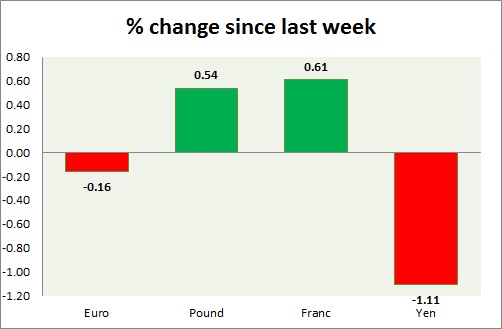

Strength meter (since last week) – Euro -0.16%, Franc +0.61%, Yen -1.11%, GBP +0.54%

EUR/USD –

Trading at 1.135

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Sell

Support

- Long term – 1.08, Medium term – 1.10, Short term – 1.10

Resistance –

- Long term – 1.2, Medium term – 1.16, Short term – 1.145

Economic release today –

- Euro Zone GDP rose 1.7% y/y in first quarter.

Commentary –

- Euro is almost flat for the week looking for further cue, after big move last week.

GBP/USD –

Trading at 1.458

Trend meter –

- Long term – Buy, Medium term – Buy, Short term – Range/Sell

Support –

- Long term – 1.4, Medium term – 1.4, Short term – 1.427

Resistance –

- Long term – 1.49, Medium term – 1.47, Short term – 1.47

Economic release today –

- Halifax house prices rose 9.2% y/y in May.

Commentary –

- Pound gained sharply in Asian hours, due to a big fat finger trade, to trade as high as 1.468 and dropped from there to 1.449 and now trading around 1.458

USD/JPY –

Trading at 107.6

Trend meter –

- Long term – Sell, Medium term – Range/ Sell, Short term – Sell

Support –

- Long term – 98.5, Medium term – 102.8, Short term – 105

Resistance –

- Long term – 121, Medium term – 115, Short term – 111.2

Economic release today –

- NIL

Commentary –

- Yen is worst performer this week on rising risk affinity. Active call – Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5 First three target reached, new target 90 added.

USD/CHF –

Trading at 0.968

Trend meter –

- Long term – Buy, Medium term – Range, Short term – Range/Sell

Support –

- Long term – 0.905, Medium term – 0.927, Short term – 0.95

Resistance –

- Long term – 1.037, Medium term – 1.01, Short term – 1

Economic release today –

- Swiss FX reserve swelled to $623 billion.

Commentary –

- Franc rose as reserve rose sharply indicating capital flow.. We expect Franc to strengthen against Dollar to as high as 0.9 area in the medium term.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022