Dollar index trading at 95.60 (+0.48%)

Strength meter (today so far) – Euro -0.52%, Franc +0.19%, Yen -0.18%, GBP -0.27%

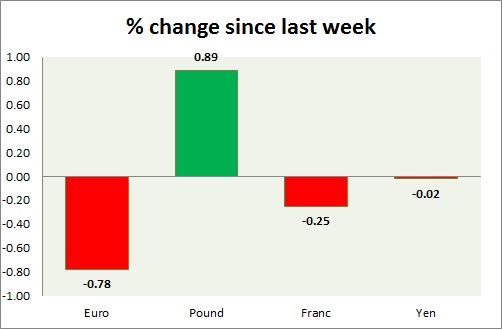

Strength meter (since last week) – Euro -0.78%, Franc -0.25%, Yen -0.02%, GBP +0.89%

EUR/USD –

Trading at 1.113

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Buy

Support

- Long term – 1.08, Medium term – 1.10, Short term – 1.115

Resistance –

- Long term – 1.2, Medium term – 1.17, Short term – 1.13

Economic release today –

- NIL

Commentary –

- Euro dropped sharply on stronger Dollar, and worst performer of the week. Our longer term target for Euro to reach as high as 1.20 against Dollar.

GBP/USD –

Trading at 1.463

Trend meter –

- Long term – Buy, Medium term – Buy, Short term – Range/Sell

Support –

- Long term – 1.4, Medium term – 1.4, Short term – 1.427

Resistance –

- Long term – 1.49, Medium term – 1.47, Short term – 1.47

Economic release today –

- NIL

Commentary –

- Pound is last man standing positive against Dollar this week, but lost grounds since yesterday.

USD/JPY –

Trading at 109.9

Trend meter –

- Long term – Sell, Medium term – Range/ Sell, Short term – Sell

Support –

- Long term – 98.5, Medium term – 102.8, Short term – 105

Resistance –

- Long term – 121, Medium term – 115, Short term – 111.2

Economic release today –

- NIL

Commentary –

- Yen is flat for the week amid heavy swings. Fourth flip of the week so far. Active call – Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5 First three target reached, new target 90 added.

USD/CHF –

Trading at 0.992

Trend meter –

- Long term – Buy, Medium term – Range, Short term – Range/Sell

Support –

- Long term – 0.905, Medium term – 0.927, Short term – 0.95

Resistance –

- Long term – 1.037, Medium term – 1.01, Short term – 1

Economic release today –

- Industrial production in first quarter rose 1%, down -2.2% for the week.

Commentary –

- Franc is down this week but much better performer. We expect Franc to strengthen against Dollar to as high as 0.9 area in the medium term.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX