Dollar index trading at 92.47 (-0.14%)

Strength meter (today so far) – Euro +0.25%, Franc +0.59%, Yen +0.37%, GBP -0.26%

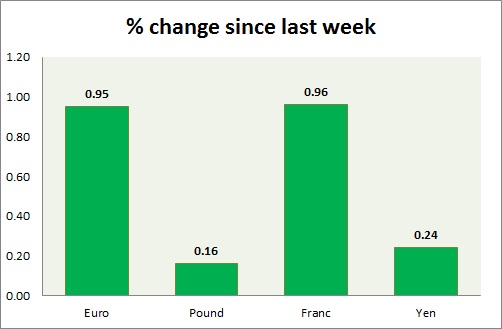

Strength meter (since last week) – Euro +0.95%, Franc +0.96%, Yen +0.24%, GBP +0.16%

EUR/USD –

Trading at 1.155

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Buy

Support

- Long term – 1.08, Medium term – 1.115, Short term – 1.125

Resistance –

- Long term – 1.17, Medium term – 1.153 (broken), Short term – 1.147 (broken)

Economic release today –

- Producer price index rose 0.3% in March, down -4.2% from a year back.

Commentary –

- Euro traded as high as 1.162 before retracing over stronger Dollar. Our longer term target for Euro to reach as high as 1.20 against Dollar.

GBP/USD –

Trading at 1.462

Trend meter –

- Long term – Buy, Medium term – Buy, Short term – Range/Buy

Support –

- Long term – 1.4, Medium term – 1.4, Short term – 1.427

Resistance –

- Long term – 1.47, Medium term – 1.467, Short term – 1.467

Economic release today –

- UK manufacturing PMI came at 49.2 for April.

Commentary –

- Pound is the worst performer today as manufacturing sector shrank for first time in almost 3 years.

USD/JPY –

Trading at 105.9

Trend meter –

- Long term – Sell, Medium term – Range/ Sell, Short term – Sell

Support –

- Long term – 98.5, Medium term – 102.8, Short term – 105

Resistance –

- Long term – 121, Medium term – 115, Short term – 111.2

Economic release today –

- NIL

Commentary –

- Yen is marginally down today after massive gain last week. Active call – Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5 First three target reached, new target 90 added.

USD/CHF –

Trading at 0.949

Trend meter –

- Long term – Buy, Medium term – Range, Short term – Range/Sell

Support –

- Long term – 0.905, Medium term – 0.927, Short term – 0.95 (testing)

Resistance –

- Long term – 1.037, Medium term – 1.01, Short term – 0.98

Economic release today –

- SECO consumer climate declined to -15 from -14 prior.

Commentary –

- Franc has broken below 0.95 area but yet not decisively. Still best performer today. We expect Franc to strengthen against Dollar to as high as 0.9 area.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022