Dollar index trading at 93.33 (-0.5%)

Strength meter (today so far) – Euro +0.64%, Franc +0.51%, Yen +0.77%, GBP +0.13%

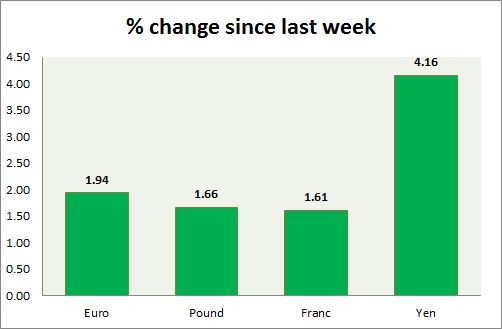

Strength meter (since last week) – Euro +1.94%, Franc +1.61%, Yen +4.16%, GBP +1.66%

EUR/USD –

Trading at 1.143

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Sell

Support

- Long term – 1.08, Medium term – 1.115, Short term – 1.125

Resistance –

- Long term – 1.17, Medium term – 1.153, Short term – 1.147

Economic release today –

- Euro Zone unemployment dropped to 10.2% in March.

- Euro Zone GDP grew 0.6% q/q in first quarter, up 1.6% from a year ago.

- Consumer prices declined -0.2% y/y in April, core grew 0.8% compared to 1% prior.

Commentary –

- Euro broken above 1.14 on weaker Dollar and on its way to test psychologically significant 1.15 area. Our longer term target for Euro to reach as high as 1.20 against Dollar. Active short term call – Sell Euro @1.132 with target at 1.085 and stop loss at 1.148

GBP/USD –

Trading at 1.463

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Range

Support –

- Long term – 1.4, Medium term – 1.4, Short term – 1.427

Resistance –

- Long term – 1.467, Medium term – 1.467, Short term – 1.467

Economic release today –

- Net lending to individuals rose to £9.3 billion

- Mortgage approvals declined to 71, 360 in March.

Commentary –

- Pound is testing resistance above 1.467 area. Yet to break above.

USD/JPY –

Trading at 107.3

Trend meter –

- Long term – Sell, Medium term – Range/ Sell, Short term – Sell

Support –

- Long term – 98.5, Medium term – 108, Short term – 108

Resistance –

- Long term – 121, Medium term – 115, Short term – 111.2

Economic release today –

- NIL

Commentary –

- Yen is up more than 4% this week. Active call – Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5 First three target reached, new target 90 added.

USD/CHF –

Trading at 0.961

Trend meter –

- Long term – Buy, Medium term – Range, Short term – Range/Sell

Support –

- Long term – 0.905, Medium term – 0.927, Short term – 0.95

Resistance –

- Long term – 1.037, Medium term – 1.01, Short term – 0.98

Economic release today –

- KOF leading indicator came at 102.7 for April, lower than 102.8 prior.

Commentary –

- Franc needs to break resistance around 0.95 area for further gains. It is moving in line with Euro and once again on its way to test key resistance. We expect Franc to strengthen against Dollar to as high as 0.9 area.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022