Dollar index trading at 94.57 (-0.22%)

Strength meter (today so far) – Euro +0.29%, Franc +0.19%, Yen +0.15%, GBP +0.79%

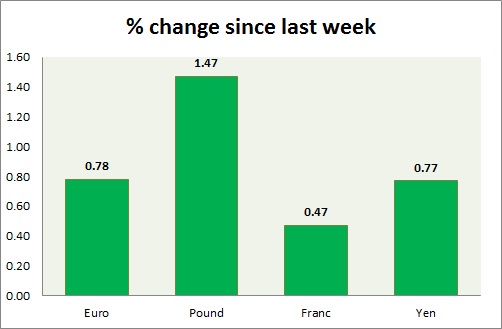

Strength meter (since last week) – Euro +0.78%, Franc +0.47%, Yen +0.77%, GBP +1.47%

EUR/USD –

Trading at 1.131

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Buy

Support

- Long term – 1.08, Medium term – 1.115, Short term – 1.125

Resistance –

- Long term – 1.17, Medium term – 1.153, Short term – 1.147

Economic release today –

- NIL

Commentary –

- Euro is higher ahead of FED tomorrow. Our longer term target for Euro to reach as high as 1.20 against Dollar. Euro may drop towards 1.12 area in the near term before buying re-begin.

GBP/USD –

Trading at 1.46

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Range

Support –

- Long term – 1.4, Medium term – 1.4, Short term – 1.427

Resistance –

- Long term – 1.467, Medium term – 1.45, Short term – 1.45

Economic release today –

- BBA mortgage approvals declined to 45, 096 in March.

Commentary –

- Pound remains as best performer today, riding on Obama’s weekend appeal to Britons to stay in EU. Polls suggests people have tilted in favor of stay.

USD/JPY –

Trading at 110.9

Trend meter –

- Long term – Sell, Medium term – Range/ Sell, Short term – Sell

Support –

- Long term – 98.5, Medium term – 108, Short term – 108

Resistance –

- Long term – 121, Medium term – 115, Short term – 111.2

Economic release today –

- NIL

Commentary –

- Yen is up this week but focus is on BOJ on Thursday. Active call – Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5

USD/CHF –

Trading at 0.972

Trend meter –

- Long term – Buy, Medium term – Range, Short term – Range/Sell

Support –

- Long term – 0.905, Medium term – 0.927, Short term – 0.95

Resistance –

- Long term – 1.037, Medium term – 1.01, Short term – 0.98

Economic release today –

- NIL

Commentary –

- Franc needs to break resistance around 0.95 area for further gains. We expect Franc to strengthen against Dollar to as high as 0.9 area.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022