Dollar index trading at 94.9 (+0.30%)

Strength meter (today so far) – Euro -0.35%, Franc -0.28%, Yen -1.63%, GBP +0.46%

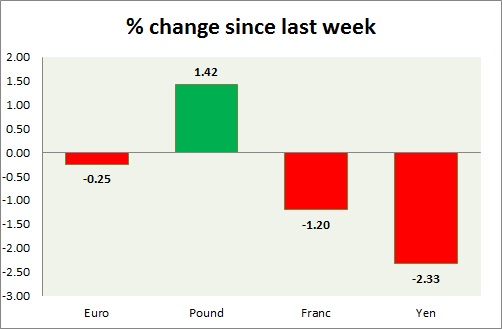

Strength meter (since last week) – Euro -0.25%, Franc -1.20%, Yen -2.33%, GBP +1.42%

EUR/USD –

Trading at 1.125

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Buy

Support

- Long term – 1.08, Medium term – 1.115, Short term – 1.125

Resistance –

- Long term – 1.17, Medium term – 1.153, Short term – 1.147

Economic release today –

- Euro zone manufacturing PMI came at 51.5 and services PMI at 53.2.

Commentary –

- Euro gave up all the gains after Draghi speech yesterday and again down today. Our longer term target for Euro to reach as high as 1.20 against Dollar. Euro may drop towards 1.12 area in the near term before buying re-begin.

GBP/USD –

Trading at 1.439

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Range

Support –

- Long term – 1.4, Medium term – 1.4, Short term – 1.427

Resistance –

- Long term – 1.467, Medium term – 1.45, Short term – 1.45

Economic release today –

- NIL

Commentary –

- Pound remains as best performer of the week, rose against almost all currencies. We are withdrawing our bull call for GBP/USD as price broke below 1.406 support. Likely to drop further now. We expect Pound to reach as low as 1.32 area.

USD/JPY –

Trading at 111.2

Trend meter –

- Long term – Sell, Medium term – Range/ Sell, Short term – Sell

Support –

- Long term – 98.5, Medium term – 108, Short term – 108

Resistance –

- Long term – 121, Medium term – 115, Short term – 111.2

Economic release today –

- NIL

Commentary –

- Yen weakened sharply today as rumor of negative rates in next week’s policy hits market. Active call – Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5

USD/CHF –

Trading at 0.977

Trend meter –

- Long term – Buy, Medium term – Range, Short term – Range/Sell

Support –

- Long term – 0.905, Medium term – 0.927, Short term – 0.95

Resistance –

- Long term – 1.037, Medium term – 1.01, Short term – 0.98

Economic release today –

- NIL

Commentary –

- Franc failed to break 0.95 area, focus on FOMC next week.. We expect Franc to strengthen against Dollar to as high as 0.9 area.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX