Dollar index trading at 94.17 (-0.34%)

Strength meter (today so far) – Euro +0.43%, Franc +0.32%, Yen -0.12%, GBP +0.72%

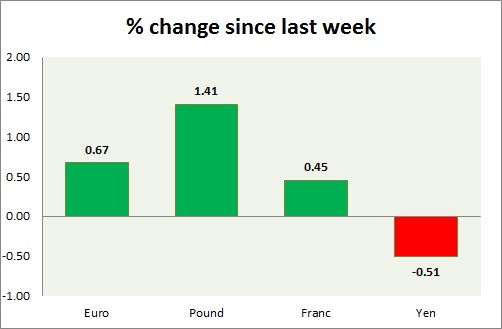

Strength meter (since last week) – Euro +0.67%, Franc +0.45%, Yen -0.51%, GBP +1.41%

EUR/USD –

Trading at 1.131

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Buy

Support

- Long term – 1.048, Medium term – 1.07, Short term – 1.108

Resistance –

- Long term – 1.15, Medium term – 1.147, Short term – 1.147

Economic release today –

- Current account balance for February came at €19 billion.

- Construction output declined -1.1% m/m in February, up 2.5% from a year back.

- Zew survey economic sentiment rose to 21.5 for April compared to 10.6 in March.

Commentary –

- Euro is grinding higher on weaker Dollar but still lacking the escape velocity required to break the range high. Our longer term target for Euro to reach as high as 1.20 against Dollar. Euro may drop towards 1.12 area in the near term before buying re-begin.

GBP/USD –

Trading at 1.418

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Range

Support –

- Long term – 1.35, Medium term – 1.38, Short term – 1.406

Resistance –

- Long term – 1.463, Medium term – 1.45, Short term – 1.436

Economic release today –

- BOE Carney is scheduled to speak at 14:35 GMT.

Commentary –

- Pound is best performer of the week and today as short covering in Pound/Yen is giving a boost. We are withdrawing our bull call for GBP/USD as price broke below 1.406 support. Likely to drop further now. We expect Pound to reach as low as 1.32 area.

USD/JPY –

Trading at 108.4

Trend meter –

- Long term – Sell, Medium term – Range/ Sell, Short term – Sell

Support –

- Long term – 98.5, Medium term – 108 (testing), Short term – 108 (testing)

Resistance –

- Long term – 121, Medium term – 117, Short term – 115

Economic release today –

- Trade balance for March to be released at 23:50 GMT.

Commentary –

- Yen reversed its early morning gains yesterday and now stands as worst performer of the week. Active call – Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5

USD/CHF –

Trading at 0.965

Trend meter –

- Long term – Buy, Medium term – Range, Short term – Range/Sell

Support –

- Long term – 0.905, Medium term – 0.945, Short term – 0.95

Resistance –

- Long term – 1.174, Medium term – 1.07, Short term – 1.035

Economic release today –

- NIL

Commentary –

- Franc needs to break 0.95 resistance for further gains. We expect Franc to strengthen against Dollar to as high as 0.9 area.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed