Dollar index trading at 94.54 (+0.51%)

Strength meter (today so far) – Euro -0.67%, Franc -0.66%, Yen -0.32%, GBP -0.07%

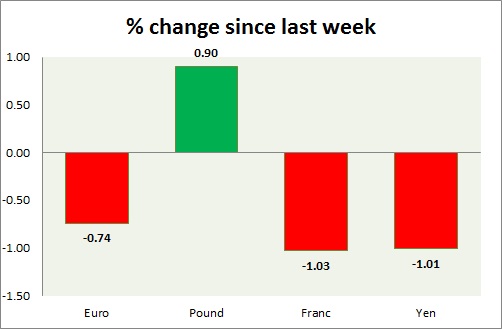

Strength meter (since last week) – Euro -0.74%, Franc -1.03%, Yen -1.01%, GBP +0.90%

EUR/USD –

Trading at 1.131

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Buy

Support

- Long term – 1.048, Medium term – 1.07, Short term – 1.108

Resistance –

- Long term – 1.15, Medium term – 1.147, Short term – 1.147

Economic release today –

- Industrial production up 0.8% y/y in February but declined monthly by same amount.

Commentary –

- Euro dropped sharply, failing to break higher above 1.15 area. Our longer term target for Euro to reach as high as 1.20 against Dollar. Euro may drop towards 1.12 area in the near term before buying re-begin.

GBP/USD –

Trading at 1.425

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Range

Support –

- Long term – 1.35, Medium term – 1.38, Short term – 1.406

Resistance –

- Long term – 1.463, Medium term – 1.45, Short term – 1.436

Economic release today –

- CB leading economic index will be released at 23:00 GMT.

Commentary –

- Pound is down today but best performer of the week. Finding support around 1.42 area. We are withdrawing our bull call for GBP/USD as price broke below 1.406 support. Likely to drop further now. We expect Pound to reach as low as 1.32 area.

USD/JPY –

Trading at 109.1

Trend meter –

- Long term – Sell, Medium term – Range/ Sell, Short term – Sell

Support –

- Long term – 98.5, Medium term – 108 (testing), Short term – 108 (broken)

Resistance –

- Long term – 121, Medium term – 117, Short term – 115

Economic release today –

- NIL

Commentary –

- Yen again declined today, likely to weaken further before buying resumes. Active call – Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5

USD/CHF –

Trading at 0.962

Trend meter –

- Long term – Buy, Medium term – Range, Short term – Range/Sell

Support –

- Long term – 0.905, Medium term – 0.945, Short term – 0.95

Resistance –

- Long term – 1.174, Medium term – 1.07, Short term – 1.035

Economic release today –

- NIL

Commentary –

- Franc failed to break below 0.95 area, in this run. We expect Franc to strengthen against Dollar to as high as 0.9 area.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022