Dollar index trading at 94.45 (-0.20%)

Strength meter (today so far) – Euro +0.36%, Franc +0.37%, Yen +0.41%, GBP -0.47%

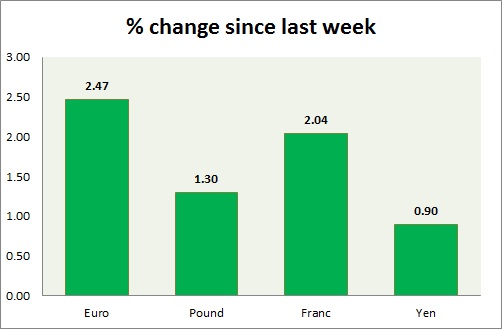

Strength meter (since last week) – Euro +2.47%, Franc +2.04%, Yen +0.9%, GBP +1.30%

EUR/USD –

Trading at 1.143

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Buy

Support

- Long term – 1.048, Medium term – 1.07, Short term – 1.108

Resistance –

- Long term – 1.15, Medium term – 1.147, Short term – 1.137 (broken)

Economic release today –

- Markit manufacturing PMI came at 51.6 for March.

Commentary –

- Euro is best performer this week. Our longer term target for Euro to reach as high as 1.20 against Dollar. However in the short run it might find resistance around 1.143 area.

GBP/USD –

Trading at 1.43

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Range/Buy

Support –

- Long term – 1.35, Medium term – 1.38, Short term – 1.406

Resistance –

- Long term – 1.463, Medium term – 1.45, Short term – 1.43 (broken)

Economic release today –

- UK manufacturing PMI came at 51.

Commentary –

- Pound is the worst performer today and only major to be in red as Brexit fear continue to weigh over it. We expects pound to grow stronger going ahead. Likely to gain towards 1.5 area. However some profit bookings suggested around 1.467 area.

USD/JPY –

Trading at 112

Trend meter –

- Long term – Sell, Medium term – Range/ Sell, Short term – Sell

Support –

- Long term – 98.5, Medium term – 108, Short term – 110

Resistance –

- Long term – 121, Medium term – 117, Short term – 115

Economic release today –

- Manufacturing PMI came at 49.1

Commentary –

- Yen is finding resistance at 112 per Dollar. Active call – Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5

USD/CHF –

Trading at 0.957

Trend meter –

- Long term – Buy, Medium term – Range, Short term – Range/Sell

Support –

- Long term – 0.905, Medium term – 0.945, Short term – 0.96 (broken)

Resistance –

- Long term – 1.174, Medium term – 1.07, Short term – 1.035

Economic release today –

- Real retail sales declined by -0.2%.

- PMI rose to 53.2

Commentary –

- Franc is moving in line with Euro. We expect Franc to strengthen against Dollar to as high as 0.9 area.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed