Dollar index trading at 94.85 (-0.35%)

Strength meter (today so far) – Euro +0.36%, Franc +0.30%, Yen +0.22%, GBP +0.21%

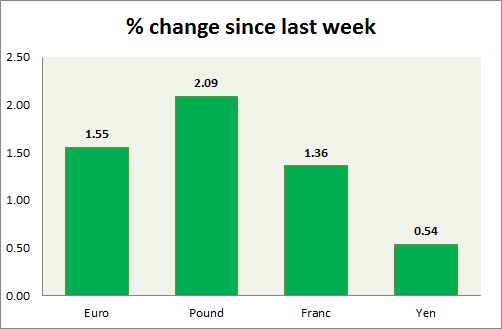

Strength meter (since last week) – Euro +1.55%, Franc +1.36%, Yen +0.54%, GBP +2.09%

EUR/USD –

Trading at 1.132

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Buy

Support

- Long term – 1.048, Medium term – 1.07, Short term – 1.108

Resistance –

- Long term – 1.15, Medium term – 1.137, Short term – 1.137

Economic release today –

- Euro Zone business climate improved to 0.11

- Economic sentiment deteriorated to 103

- Services sentiment deteriorated to 9.6, consumer confidence to -9.7 and industrial confidence to -4.2

Commentary –

- Euro broke 1.12 consolidation area as Dollar weaken post Yellen comments. Our longer term target for Euro to reach as high as 1.20 against Dollar. However in the short run it might find resistance around 1.143 area.

GBP/USD –

Trading at 1.441

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Range/Buy

Support –

- Long term – 1.35, Medium term – 1.38, Short term – 1.406

Resistance –

- Long term – 1.463, Medium term – 1.45, Short term – 1.43

Economic release today –

- NIL

Commentary –

- Pound from worst performer last week, to best performer today. We expects pound to grow stronger going ahead. Likely to gain towards 1.5 area. However some profit bookings suggested around 1.467 area.

USD/JPY –

Trading at 112.5

Trend meter –

- Long term – Sell, Medium term – Range/ Sell, Short term – Sell

Support –

- Long term – 98.5, Medium term – 108, Short term – 110

Resistance –

- Long term – 121, Medium term – 117, Short term – 115

Economic release today –

- Industrial production for February will be released at 23:50 GMT.

Commentary –

- Yen is worst performer today but now in positive against Dollar. Active call – Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5

USD/CHF –

Trading at 0.963

Trend meter –

- Long term – Buy, Medium term – Range, Short term – Range/Sell

Support –

- Long term – 0.905, Medium term – 0.945, Short term – 0.96

Resistance –

- Long term – 1.174, Medium term – 1.07, Short term – 1.035

Economic release today –

- NIL

Commentary –

- Franc is taking broad cue from Dollar and Euro’s move. We expect Franc to strengthen against Dollar to as high as 0.9 area.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX