Dollar index trading at 96.55 (+0.39%)

Strength meter (today so far) – Euro +0.02%, Franc +0.1%, Yen +0.96%, GBP -0.82%

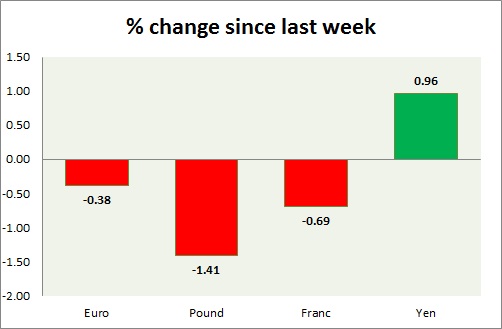

Strength meter (since last week) – Euro -0.38%, Franc -0.69%, Yen +0.96%, GBP -1.41%

EUR/USD –

Trading at 1.11

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Sell

Support

- Long term – 1.048, Medium term – 1.07, Short term – 1.078

Resistance –

- Long term – 1.15, Medium term – 1.137, Short term – 1.12

Economic release today –

- Employment rose by 0.3% in fourth quarter.

Commentary –

- Euro is consolidating around 1.11 area, awaiting the FOMC.

GBP/USD –

Trading at 1.433

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Range/Sell

Support –

- Long term – 1.35, Medium term – 1.35, Short term – 1.38

Resistance –

- Long term – 1.463, Medium term – 1.44, Short term – 1.44

Economic release today –

- NIL

Commentary –

- Pound is worst performer today and this week as sellers increase position focusing on Brexit.

USD/JPY –

Trading at 112.7

Trend meter –

- Long term – Sell, Medium term – Range/ Sell, Short term – Sell

Support –

- Long term – 98.5, Medium term – 108, Short term – 110

Resistance –

- Long term – 121, Medium term – 117, Short term – 115

Economic release today –

- Bank of Japan held policy steady today. Tertiary industry index rose 1.5% in January. Capacity utilization rose by 2.6%.

Commentary –

- Yen is best performer today and this week as equities and oil slid. Active call – Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5

USD/CHF –

Trading at 0.987

Trend meter –

- Long term – Buy, Medium term – Range, Short term – Range/Sell

Support –

- Long term – 0.905, Medium term – 0.945, Short term – 0.98

Resistance –

- Long term – 1.174, Medium term – 1.07, Short term – 1.035

Economic release today –

- NIL

Commentary –

- Franc is moving in line with Euro.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX