Dollar index trading at 96.46 (+0.30%)

Strength meter (today so far) - Euro -0.45%, Franc -0.10%, Yen -0.70%, GBP +0.38%

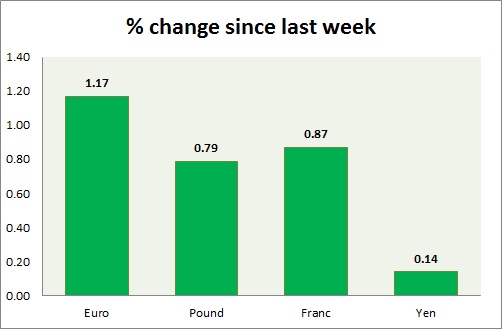

Strength meter (since last week) - Euro +1.17%, Franc +0.87%, Yen +0.14%, GBP +0.79%

EUR/USD -

Trading at 1.113

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Sell

Support

- Long term - 1.048, Medium term - 1.07, Short term - 1.078

Resistance -

- Long term - 1.15, Medium term - 1.137, Short term - 1.107

Economic release today -

- NIL

Commentary -

- Euro is best performer of the week, despite ECB stimulus.

GBP/USD -

Trading at 1.433

Trend meter -

- Long term - Sell, Medium term - Sell, Short term - Range/Sell

Support -

- Long term - 1.35, Medium term - 1.35, Short term - 1.38

Resistance -

- Long term - 1.463, Medium term - 1.425, Short term - 1.405

Economic release today -

- Goods trade balance came at -£3.46 billion.

Commentary -

- Pound is best performer today

USD/JPY -

Trading at 113.5

Trend meter -

- Long term - Sell, Medium term - Range/ Sell, Short term - Sell

Support -

- Long term - 98.5, Medium term - 108, Short term - 110

Resistance -

- Long term - 121, Medium term - 117, Short term - 115

Economic release today -

- NIL

Commentary -

- Yen is the worst performer of the week but still up against Dollar. Active call - Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5

USD/CHF -

Trading at 0.984

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Sell

Support -

- Long term - 0.905, Medium term - 0.945, Short term - 0.98

Resistance -

- Long term - 1.174, Medium term - 1.07, Short term - 1.035

Economic release today -

- NIL

Commentary -

- Franc is second best performer of the week.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed