Dollar index trading at 97.39 (-0.05%).

Strength meter (today so far) - Euro +0.01%, Franc -0.14%, Yen +0.20%, GBP +0.13%

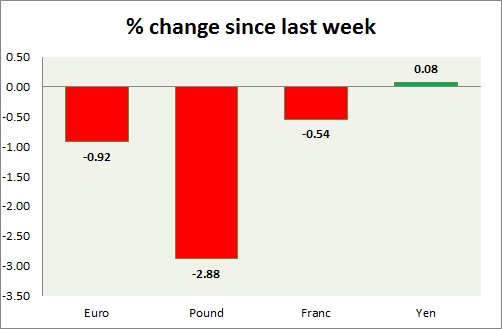

Strength meter (since last week) - Euro -0.92%, Franc -0.54%, Yen -0.31%, GBP -2.88%

EUR/USD -

Trading at 1.102

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Sell

Support

- Long term - 1.048, Medium term - 1.07, Short term - 1.078

Resistance -

- Long term - 1.18, Medium term - 1.15, Short term - 1.13

Economic release today -

- Euro Zone consumer confidence dropped to -8.8, industrial confidence dropped 4.4, services sentiment dropped to 10.6, business climate dropped to 0.7, economic sentiment dropped to 103.8

Commentary -

- Euro is consolidating as ECB nears.

GBP/USD -

Trading at 1.397

Trend meter -

- Long term - Sell, Medium term - Sell, Short term - Range/Sell

Support -

- Long term - 1.35, Medium term - 1.35, Short term - 1.385

Resistance -

- Long term - 1.46, Medium term - 1.44, Short term - 1.427

Economic release today -

- NIL

Commentary -

- Pound despite gains since yesterday, ending the week on ugly note.

USD/JPY -

Trading at 112.9

Trend meter -

- Long term - Sell, Medium term - Range/ Sell, Short term - Sell

Support -

- Long term - 98.5, Medium term - 108, Short term - 110

Resistance -

- Long term - 121, Medium term - 117, Short term - 115

Economic release today -

- NIL

Commentary -

- Yen is on its way to end the week, marginally higher. Might lose further ground ahead. Active call - Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5

USD/CHF -

Trading at 0.992

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Sell

Support -

- Long term - 0.905, Medium term - 0.945, Short term - 0.98

Resistance -

- Long term - 1.174, Medium term - 1.07, Short term - 1.035

Economic release today -

- NIL

Commentary -

- Franc is relatively better performer thanks to risk aversion. Active call - Sell USD/CHF @0.985 and at rallies - targeting 0.895 area and stop loss at 1.03 area.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed