Dollar index trading at 97.96 (+0.05%).

Strength meter (today so far) - Euro +0.12%, Franc +0.47%, Yen -0.23%, GBP -0.14%

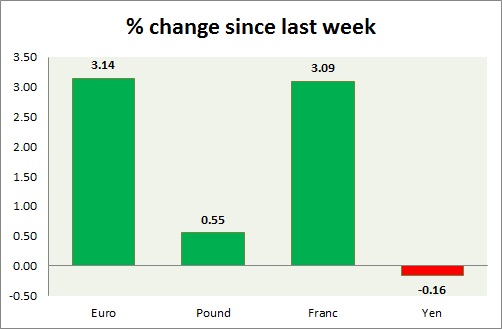

Strength meter (since last week) - Euro +3.14%, Franc +3.09%, Yen -0.16%, GBP +0.55%

EUR/USD -

Trading at 1.092

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range

Support

- Long term - 0.98, Medium term - 1.02, Short term - 1.048

Resistance -

- Long term - 1.145, Medium term - 1.104, Short term - 1.083 (broken)

Economic release today -

- NIL

Commentary -

- Euro is up despite strong nonfarm payroll from US and ECB's lack of stimulus is weighing.

GBP/USD -

Trading at 1.511

Trend meter -

- Long term - Buy, Medium term - Range/sell, Short term - Range

Support -

- Long term - 1.46, Medium term - 1.475, Short term - 1.495

Resistance -

- Long term - 1.55, Medium term - 1.54, Short term - 1.532

Economic release today -

- NIL

Commentary -

- Pound retraced back from channel floor, might go for larger correction. Active call - Sell Pound @1.54 targeting 1.44 area with stop loss around 1.58 area.

USD/JPY -

Trading at 123

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Range/Buy

Support -

- Long term - 115.5-116.5, Medium term - 118.5, Short term - 120.3

Resistance -

- Long term - 130, Medium term - 128, Short term - 125.4

Economic release today -

- Wage growth at 0.7% y/y.

- Consumer confidence rose to 42.6.

Commentary -

- Yen is worst performer this week. Active call - Buy USD/JPY @ 121.9 targeting 123.2, 125, 127, with stop loss around 120, 118.

USD/CHF -

Trading at 0.998

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 0.905, Medium term - 0.945, Short term - 1.01

Resistance -

- Long term - 1.174, Medium term - 1.07, Short term - 1.035

Economic release today -

- NIL

Commentary -

- Franc is the second best performer this week, broken below parity against Dollar.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX