Dollar index trading at 98.81 (+0.11%).

Strength meter (today so far) - Euro -0.22%, Franc -0.23%, Yen -0.16%, GBP -0.33%

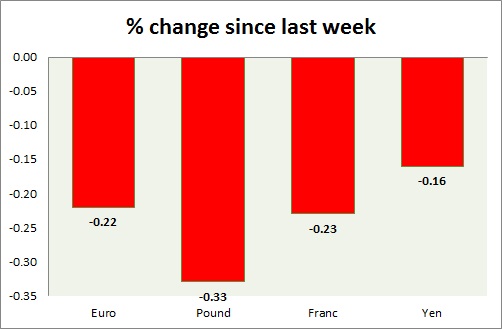

Strength meter (since last week) - Euro -0.22%, Franc -0.23%, Yen -0.16%, GBP -0.33%

EUR/USD -

Trading at 1.062

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Sell

Support

- Long term - 1.048-1.036, Medium term - 1.065-1.06, Short term - 1.06

Resistance -

- Long term - 1.175-1.18, Medium term - 1.15, Short term - 1.11, Immediate - 1.08 area

Economic release today -

- Euro Zone PMI came at 54.6 services and 52.8 for manufacturing.

Commentary -

- Euro grinding lower as ECB is closing in, scheduled next week. Active call - Euro to drop towards parity.

GBP/USD -

Trading at 1.513

Trend meter -

- Long term - Buy, Medium term - Range/sell, Short term - Range/Sell

Support -

- Long term - 1.425-1.417, Medium term - 1.497-1.49, Short term - 1.5

Resistance -

- Long term - 1.592-1.616, Medium term - 1.585, Short term - 1.55, Immediate - 1.53 (broken)

Economic release today -

- NIL

Commentary -

- Pound is continuing its drop after Friday's mega selloff, worst performer today. Active call - Sell Pound @1.54 targeting 1.44 area with stop loss around 1.58 area.

USD/JPY -

Trading at 123

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Range/Buy

Support -

- Long term - 113.7-112.9, Medium term - 116-115, Short term - 119.5

Resistance -

- Long term - 130, Medium term - 126, Short term - 123.5

Economic release today -

- NIL

Commentary -

- Yen is relatively better performer, as commodities sell-offs raising some concerns Active call - Buy USD/JPY @ 121.9 targeting 123.2, 125, 127, with stop loss around 120, 118.

USD/CHF -

Trading at 1.02

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 0.88, Medium term - 0.93, Short term - 0.95, Immediate -0.98

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 1.025

Economic release today -

- NIL

Commentary -

- Franc is slowly grinding towards target around 1.03 area.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate