Dollar index trading at 97.73 (+0.56%).

Strength meter (today so far) - Euro -0.80%, Franc -0.17%, Yen -0.36%, GBP -0.20%

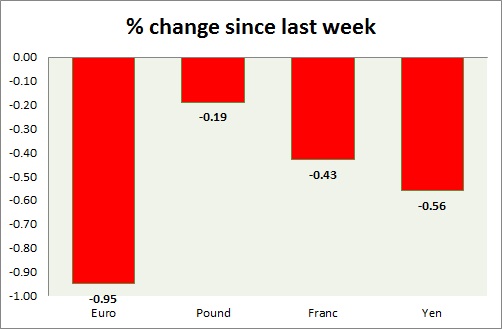

Strength meter (since last week) - Euro -0.95%, Franc -0.43%, Yen -0.56%, GBP -0.19%

EUR/USD -

Trading at 1.089

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Sell

Support

- Long term - 1.048-1.036, Medium term - 1.065-1.06, Short term - 1.08-1.085

Resistance -

- Long term - 1.175-1.18, Medium term - 1.15, Short term - 1.145, immediate - 1.11 area

Economic release today -

- Euro zone services PMI came at 54.1 in October, down from 54.2 in September.

Commentary -

- Euro is worst performer of the week as expectations for further easing continue to build up. Active call - Euro to drop towards parity.

GBP/USD -

Trading at 1.539

Trend meter -

- Long term - Buy, Medium term - Range/sell, Short term - Range/buy

Support -

- Long term - 1.425-1.417, Medium term - 1.497-1.49, Short term - 1.518-1.512,

Resistance -

- Long term - 1.592-1.616, Medium term - 1.585, Short term - 1.572, Immediate - 1.55

Economic release today -

- Services PMI for October came at 54.9, robust enough and stronger than September's 53.3

Commentary -

- Pound is the best performing major this week so far. Active call - Sell Pound targeting 1.44 area with stop loss around 1.58 area.

USD/JPY -

Trading at 121.3

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Range/sell

Support -

- Long term - 113.7-112.9, Medium term - 116-115, Short term - 119.5

Resistance -

- Long term - 130, Medium term - 126, Short term - 121.7

Economic release today -

- Japan services PMI came at 52.2 much better than prior 51.4.

- Consumer confidence inched up to 41.5 in October, compared to 40.6 in September.

Commentary -

- Yen is relatively better performer today but struggling clearly against Dollar. Active call - Sell USD/JPY targeting 114.7 area with stop loss around 122.

USD/CHF -

Trading at 0.991

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 0.88, Medium term - 0.90, Short term - 0.93, Immediate -0.95

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 1

Economic release today -

- NIL

Commentary -

- Franc after a long time is the best performing major for the day, however overall weakness to Franc is likely to persist. Parity is proving to be key resistance.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary