Dollar index trading at 93.72 (+0.21%)

Strength meter (today so far) – Euro -0.16%, Franc -0.36%, Yen -0.40%, GBP -0.46%

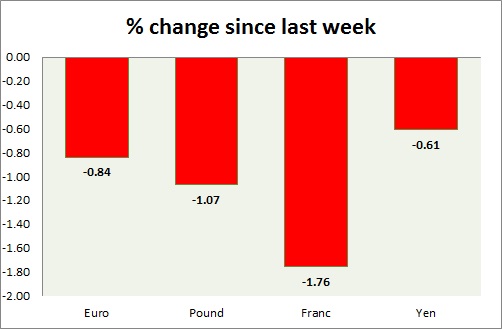

Strength meter (since last week) – Euro -0.84%, Franc -1.76%, Yen -0.61%, GBP -1.07%

EUR/USD –

Trading at 1.179

Trend meter –

- Long term – Buy, Medium term – Buy, Short term – Sell

Support

- Long term – 1.14, Medium term – 1.16, Short term – 1.16

Resistance –

- Long term – 1.22, Medium term – 1.22, Short term – 1.2

Economic release today –

- Third quarter GDP rose 0.6 percent, up 2.6 percent from a year ago.

Commentary –

- The euro is down this week as the dollar recovers on tax proposal clearing Senate hurdle and Brexit uncertainties. Active call – Sell targeting 1.14

GBP/USD –

Trading at 1.334

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 1.28, Medium term – 1.295, Short term – 1.32

Resistance –

- Long term – 1.38 Medium term – 1.36, Short term – 1.35

Economic release today –

- Halifax house price index up 0.5 percent in November, up 3.9 percent from a year ago.

Commentary –

- The pound is down against the dollar over Irish border dispute stalling Brexit talks.

USD/JPY –

Trading at 112.7

Trend meter –

- Long term – Sell, Medium term – sell, Short term – Range/Sell

Support –

- Long term – 107, Medium term – 108.4, Short term – 108.4

Resistance –

- Long term – 116, Medium term – 114.2, Short term – 114.2

Economic release today –

- Third quarter GDP data will be released at 23:50 GMT, along with October trade balance report.

Commentary –

- The yen is down this week as the dollar and equities rise, however, recovered some of the losses as U.S. government shutdown looms ahead. Active call – Buy yen targeting 101

USD/CHF –

Trading at 0.993

Trend meter –

- Long term – Buy, Medium term – Range/sell, Short term – Range/Sell

Support –

- Long term – 0.90, Medium term – 0.92, Short term – 0.95

Resistance –

- Long term – 1.04, Medium term – 1.01, Short term – 1.00

Economic release today –

- Unemployment rate declines to 3 percent in November.

- Forex reserve marginally declines to 738 billion in October.

Commentary –

- Franc is the worst performer this week. Active call – Buy pair targeting 1.02

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022