Dollar index trading at 94.27 (-0.52%).

Strength meter (today so far) - Euro +0.46%, Franc +0.60%, Yen +0.41%, GBP +1.17%

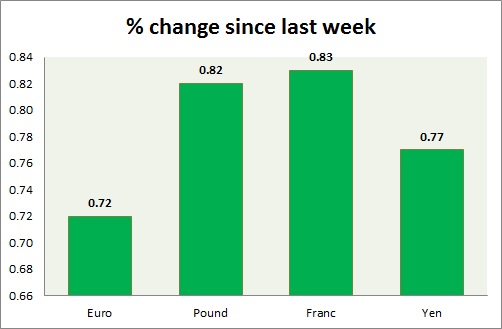

Strength meter (since last week) - Euro +0.72%, Franc +0.83%, Yen +0.77%, GBP +0.82%

EUR/USD -

Trading at 1.143

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support

- Long term - 1.048-1.036, Medium term - 1.065-1.06, Short term - 1.08-1.085, Immediate - 1.109

Resistance -

- Long term - 1.175-1.18, Medium term - 1.15, Short term - 1.145

Economic release today -

- Industrial production dropped -0.5% in August, still up 0.9% from a year ago.

Commentary -

- Euro gained over weaker retail sales in US, further rise towards 1.157 is likely. Next target is around 1.145.

GBP/USD -

Trading at 1.543

Trend meter -

- Long term - Buy, Medium term - Range/sell, Short term - Range/buy

Support -

- Long term - 1.425-1.417, Medium term - 1.497-1.49, Short term - 1.518-1.512,

Resistance -

- Long term - 1.592-1.616, Medium term - 1.585, Short term - 1.572, Immediate - 1.55

Economic release today -

- UK economy moved to deflation as CPI fell -0.1% m/m and yearly basis.

Commentary -

- Pound is the best performer today. Active call - Sell Pound targeting 1.44 area with stop loss around 1.58 area. In the near term Pound is likely to rise towards 1.55 and 1.56 with support around 1.52 area.

USD/JPY -

Trading at 119.2

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Range/sell

Support -

- Long term - 113.7-112.9, Medium term - 116-115, Short term - 118.6

Resistance -

- Long term - 130, Medium term - 126, Short term - 121.7, Immediate - 120.5

Economic release today -

- Consumer confidence dropped to 40.6 in September.

Commentary -

- Yen regained some ground further as dollar is weak over the board. Active call - Sell USD/JPY targeting 114.7 area with stop loss around 122.

USD/CHF -

Trading at 0.952

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 0.88, Medium term - 0.90, Short term - 0.93, Immediate -0.95

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.984-0.987

Economic release today -

- Producer price index dropped -0.1% in September, down -6.4% from a year ago.

Commentary -

- Franc is gaining over safe haven bids as Chinese inflation slows further. Franc is very close to support now. Active Call - Buy USD/CHF with target around 1.03 area and stop around 0.95 area.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings