Dollar index trading at 95.55 (+0.10%)

Strength meter (today so far) - Aussie +0.85%, Kiwi +1.50%, Loonie +0.19%.

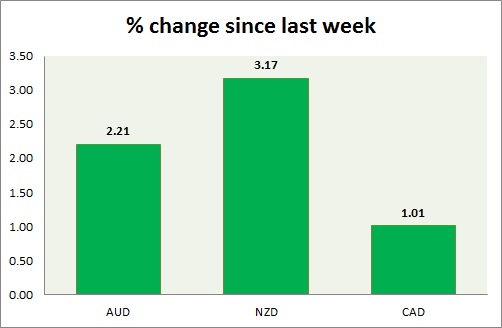

Strength meter (since last week) - Aussie +2.21%, Kiwi +3.17%, Loonie +1.01%.

AUD/USD -

Trading at 0.722

Trend meter -

- Long term - Sell, Medium term - Sell, Short term - Range

Support -

- Long term - 0.60, Medium term - 0.65, Short term - 0.685, immediate - 0.695

Resistance -

- Long term - 0.83, Medium term - 0.725, Short term - 0.725

Economic release today -

- NIL

Commentary -

- Aussie rallied higher as commodities recover globally.. Active call - Sell Aussie @ 0.76 with stop around 0.785 and 0.825 to target 0.715, 0.70, 0.685 and 0.65.

NZD/USD -

Trading at 0.6664

Trend meter -

- Long term - Sell, Medium term - Range/sell, Short term - Range

Support -

- Long term - 0.56, Medium term - 0.60, Short term - 0.615

Resistance -

- Long term - 0.71, Medium term - 0.68, Short term - 0.643-0.652

Economic release today -

- NIL

Commentary -

- Kiwi in for its next target around 0.56 against Dollar, with slowdown in China and further loosening of policy from RBNZ. Kiwi is best performer this week as higher oil price is providing support.

USD/CAD -

Trading at 1.302

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 1.19, Medium term - 1.26, Short term - 1.29,

Resistance -

- Long term - 1.38, Medium term - 1.35, Short term - 1.35

Economic release today -

- Building permits dropped by -3.7% in August from July.

Commentary -

- Loonie is up in line with broad based strength in commodity currencies. Pair is trading close to 1.3 psychological support. Might fall further as oil has broken above its current triangular consolidation.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings