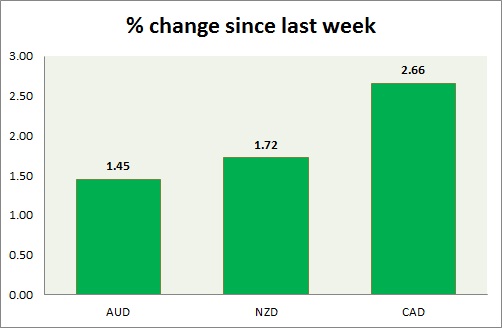

Commodity pairs (AUD, NZD, & CAD) held off well throughout last week but gave up after the release of NFP report. A chart and table is attached for explanation.

- Aussie is trying to gain some ground after Friday's bitter loss. Cot report showed that speculators held short positions at -61,500 contracts. Aussie is currently trading at 0.773. Immediate Support lies at 0.765 & Resistance 0.789.

- Kiwi lost nearly 300 points last week since it failed to break above the resistance of 0.762. Speculators maintained net short in NZD by -1300 contracts. Pair is currently trading at 0.737. Further losses can't be ruled out as key support is broken. Immediate Support lies at 0.722 & Resistance 0.75.

- Canadian dollar gained some grounds in today's trading so far after suffering big losses over non-farm payroll last Friday. Cot report showed speculators increased bets over further weakness at currently stands at -38800 contracts. Focus is on trade data to be published today. Currently trading at 1.26. Immediate Support lies at 1.24 & Resistance 1.272.

|

AUD |

0.26% |

|

NZD |

0.41% |

|

CAD |

0.16% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings