Dollar index trading at 95.95 (-0.28%)

Strength meter (today so far) - Aussie -0.38%, Kiwi -0.55%, Loonie -0.24%.

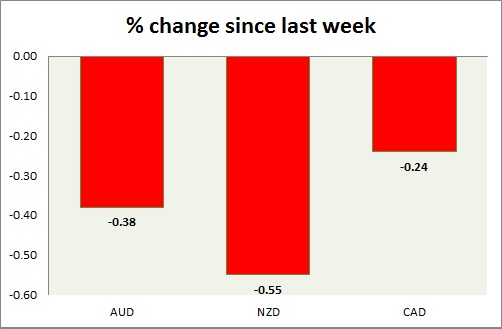

Strength meter (since last week) - Aussie -0.38%, Kiwi -0.55%, Loonie -0.24%.

AUD/USD -

Trading at 0.699

Trend meter -

- Long term - Sell, Medium term - Sell, Short term - Range/Buy

Support -

- Long term - 0.60, Medium term - 0.65, Short term - 0.685, immediate - 0.695

Resistance -

- Long term - 0.83, Medium term - 0.725, Short term - 0.725

Economic release today -

- NIL

Commentary -

- Aussie is marginally down today, however worries over China has resurfaced pushing commodities lower. It is likely to keep pressure up on Aussie.. Active call - Sell Aussie @ 0.76 with stop around 0.785 and 0.825 to target 0.715, 0.70, 0.685 and 0.65.

NZD/USD -

Trading at 0.634

Trend meter -

- Long term - Sell, Medium term - Range/sell, Short term - Range/Sell

Support -

- Long term - 0.56, Medium term - 0.60, Short term - 0.615

Resistance -

- Long term - 0.71, Medium term - 0.68, Short term - 0.643-0.65

Economic release today -

- NIL

Commentary -

- Kiwi in for its next target around 0.56 against Dollar, with slowdown in China and further loosening of policy from RBNZ. Worries on China slowdown is hitting the markets, pushing commodities down again.

USD/CAD -

Trading at 1.336

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 1.19, Medium term - 1.26, Short term - 1.29

Resistance -

- Long term - 1.38, Medium term - 1.35, Short term - 1.34

Economic release today -

- NIL

Commentary -

- Loonie is relatively better performer, but lower oil price is creating headwinds for the currency.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?