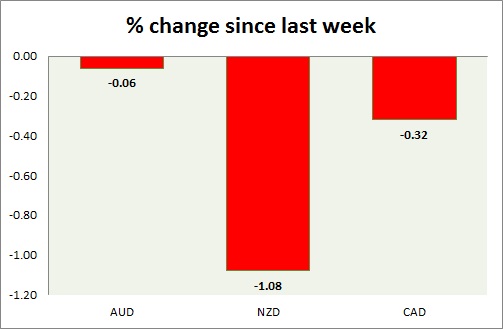

Commodity pairs (AUD, NZD, & CAD) did very well this week so far but facing headwinds in today's trading also over the ECB press conference. A chart and table is attached for explanation.

- Aussie is doing well today despite the growth downgrade from China but as the pair fails to break above the resistance it might face further pressure as NFP report looms ahead tomorrow. Retail sales data showed positive growth at 0.4% mom but trade deficit deteriorated by 0.98 billion. Aussie is currently trading at 0.779, down 0.4 percent for the day. Immediate Support lies at 0.767 & Resistance 0.792.

- Kiwi is the top loser today, after China downgraded its growth projection and it once again failed to break above the resistance and fell sharply today. Pair is currently trading at 0.7488. Immediate Support lies at 0.742 & Resistance 0.762.

- Canadian dollar is the top performer among the commodity segment as the pair is still benefiting from the rate hold by BOC and positive GDP data this week. Currently trading at 1.248. Immediate Support lies at 1.235 & Resistance 1.272.

|

AUD |

-0.06% |

|

NZD |

-1.08% |

|

CAD |

-0.32% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate