Dollar index trading at 96.05 (-1.18%)

Strength meter (today so far) - Aussie +0.82%, Kiwi +1.27%, Loonie +0.85%.

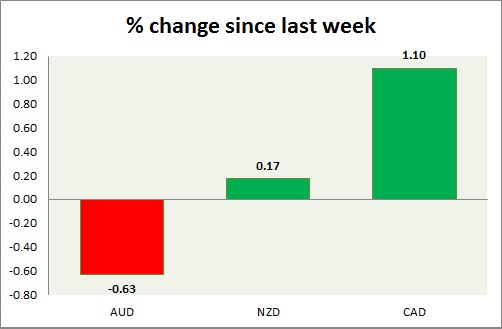

Strength meter (since last week) - Aussie -1.71%, Kiwi -1.28%, Loonie +0.02%.

AUD/USD -

Trading at 0.737

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.71-0.715

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.78, Immediate - 0.75

Economic release today -

- Westpac consumer confidence improved by 7.8% in July.

- Wages rose by 0.6% q/q in second quarter.

Commentary -

- Aussie is sharply up after initial selloffs over second consecutive Chinese devaluation. Active call - Sell Aussie with stop around 0.785 and 0.825 to target 0.715, 0.70 and 0.65.

NZD/USD -

Trading at 0.663

Trend meter -

- Long term - Sell, Medium term - Range/sell, Short term - Range/sell

Support -

- Long term - 0.653, Medium term - 0.65, Short term - 0.65

Resistance -

- Long term - 0.883, Medium term - 0.80-0.805, Short term - 0.737-0.74, Immediate - 0.705

Economic release today -

- Business PMI is scheduled for release at 22:30 GMT, followed by food price index at 22:45 GMT.

Commentary -

- Kiwi traded as low as 0.646 amid second consecutive devaluation of Yuan by PBoC, however gained back sharply over weaker Dollar.

USD/CAD -

Trading at 1.299

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 1.17, Medium term - 1.217, Short term - 1.265

Resistance -

- Long term - 1.32, Medium term - 1.315-1.32, Short term - 1.32

Economic release today -

- NIL

Commentary -

- Canadian dollar is best performing commodity pair this week as oil showing signs of turn around.. Active call - Canadian dollar remains sell against dollar, the pair might reach as high as 1.38.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand