Dollar index trading at 96.60 (-0.21%)

Strength meter (today so far) – Aussie +0.36%, Kiwi +0.83%, Loonie +0.06%

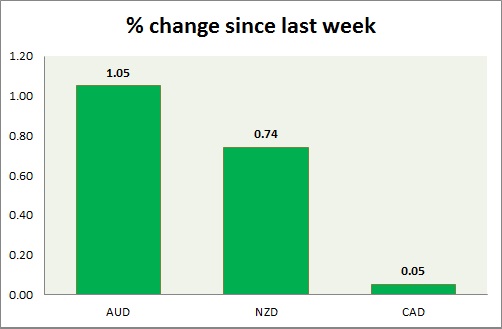

Strength meter (since last week) – Aussie +1.05%, Kiwi +0.74%, Loonie +0.05%

AUD/USD –

Trading at 0.751

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Range

Support –

- Long term – 0.71, Medium term – 0.73, Short term – 0.73

Resistance –

- Long term – 0.782, Medium term – 0.78, Short term – 0.755

Economic release today –

- Current account balance came at -3.1 billion in the first quarter.

- RBA kept interest rate unchanged at 150 basis points.

Commentary –

- The Australian dollar is the best performer of the week on better than expected data and a weaker dollar. Aussie might decline to 0.72 area once more to test support.

NZD/USD –

Trading at 0.719

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Range

Support –

- Long term – 0.66, Medium term – 0.67, Short term – 0.67

Resistance –

- Long term – 0.76, Medium term – 0.73, Short term – 0.723

Economic release today –

- The global dairy auction is scheduled today.

- Manufacturing sales report for the first quarter will be released at 22:45 GMT.

Commentary –

- Kiwi is the best performer of the day. The focus is on global dairy auction today.

USD/CAD –

Trading at 1.348

Trend meter –

- Long term – sell, Medium term – buy, Short term – Range/buy

Support –

- Long term – 1.32, Medium term – 1.33, Short term – 1.35 (testing)

Resistance –

- Long term – 1.38, Medium term – 1.38, Short term – 1.37

Economic release today –

- IVEY PMI report was released at 14:00 GMT.

Commentary –

- Loonie is the weakest performer of the week thanks to lower oil price.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX