Dollar index trading at 99.59 (+0.09%)

Strength meter (today so far) – Aussie -0.47%, Kiwi -0.40%, Loonie -0.31%

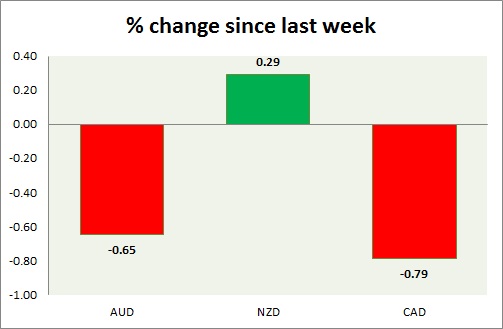

Strength meter (since last week) – Aussie -0.65%, Kiwi +0.29%, Loonie -0.79%

AUD/USD –

Trading at 0.752

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Range

Support –

- Long term – 0.71, Medium term – 0.73, Short term – 0.75

Resistance –

- Long term – 0.782, Medium term – 0.78, Short term – 0.78

Economic release today –

- Westpac leading index is up 0.1 percent in March.

- New motor vehicle sales grew 1.9 percent in March, down 3 percent from a year ago.

Commentary –

- Aussie remains downbeat as commodity prices continue to slide on weaker growth prospects in the US and China. Aussie might decline to 0.72 area once more to test support.

NZD/USD –

Trading at 0.702

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Range

Support –

- Long term – 0.66, Medium term – 0.69, Short term – 0.69

Resistance –

- Long term – 0.8, Medium term – 0.76, Short term – 0.733

Economic release today –

- First quarter consumer price inflation report will be released at 22:45 GMT.

Commentary –

- Only currency in the commodity packs to be up against the dollar, however, gave up lots of lots gains.

USD/CAD –

Trading at 1.342

Trend meter –

- Long term – sell, Medium term – buy, Short term – Range/buy

Support –

- Long term – 1.28, Medium term – 1.3, Short term – 1.3

Resistance –

- Long term – 1.38, Medium term – 1.365, Short term – 1.365

Economic release today –

- NIL

Commentary –

- The loonie is the worst performer of the week so far.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022