Dollar index trading at 100.38 (+0.20%)

Strength meter (today so far) – Aussie +0.53%, Kiwi +0.16%, Loonie -0.02%

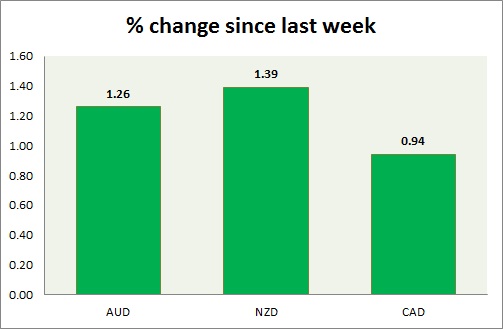

Strength meter (since last week) – Aussie +1.26%, Kiwi +1.39%, Loonie +0.94%

AUD/USD –

Trading at 0.758

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Range

Support –

- Long term – 0.71, Medium term – 0.73, Short term – 0.75

Resistance –

- Long term – 0.782, Medium term – 0.78, Short term – 0.78

Economic release today –

- Consumer inflation expectations rose to 4.1 percent in April.

- The unemployment rate remained at 5.9 percent, despite 0.2 percent increase in the participation rate as the economy adds 60,900 jobs.

Commentary –

- Sharp dollar selloff on Trump comments led to the recovery of Aussie. Aussie might decline to 0.72 area once more to test support.

NZD/USD –

Trading at 0.7

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Range

Support –

- Long term – 0.66, Medium term – 0.69, Short term – 0.69

Resistance –

- Long term – 0.8, Medium term – 0.76, Short term – 0.733

Economic release today –

- NIL

Commentary –

- Kiwi turned from worst to the best performer on a weaker dollar.

USD/CAD –

Trading at 1.325

Trend meter –

- Long term – sell, Medium term – buy, Short term – Range/buy

Support –

- Long term – 1.28, Medium term – 1.3, Short term – 1.3

Resistance –

- Long term – 1.38, Medium term – 1.365, Short term – 1.365

Economic release today –

- Manufacturing shipments declined by 0.2 percent in February.

- New house price index rose by 0.4 percent in February.

- BoC governor Poloz is scheduled to speak at 14:30 GMT.

Commentary –

- Loonie is up on weaker dollar and higher oil price.