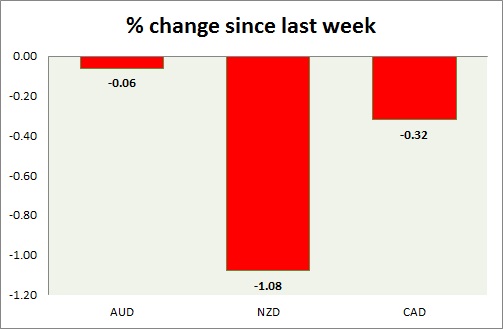

Commodity pairs (AUD, NZD, & CAD) are performing better this week over the majors even after yesterday's sharp fall over US data. A chart and table is attached for explanation.

- Aussie is the worst performer of the lot against dollar but still in minor loss this week. Today's private sector credit data showed stable growth at 6.2% YoY and 0.5% mom. The pair is trading at 0.783. Immediate Support lies at 0.767 & Resistance 0.792.

- Kiwi is the best performer, after today's business confidence data showed improvement to 34.4 compared to previous 30.4. This is five months consecutive gain, but the pair so far has failed to break above significant 0.76. It may perform well against other counterparts like Euro, Yen, Franc and Aussie. Pair is trading at 0.757. Immediate Support lies at 0.742 & Resistance 0.762.

- Canadian dollar trying to come back in today's trading after yesterday's fall over the CPI & stronger economy dockets from US. US GDP today is the main focus ahead along with Chicago PMI. The pair is currently trading at 1.245. Immediate Support lies at 1.235 & Resistance 1.272.

|

AUD |

-0.18% |

|

NZD |

0.79% |

|

CAD |

0.68% |

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary