Dollar index trading at 101.88 (+0.50%)

Strength meter (today so far) – Aussie +0.15%, Kiwi -0.83%, Loonie -0.12%

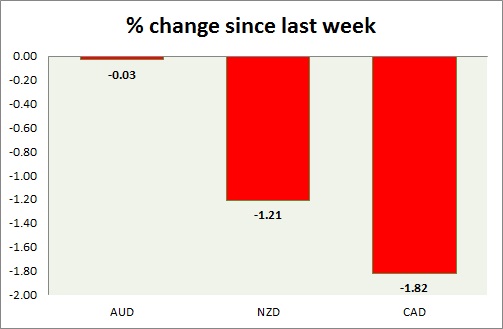

Strength meter (since last week) – Aussie -0.03%, Kiwi -0.1.21%, Loonie -1.82%

AUD/USD –

Trading at 0.765

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Buy

Support –

- Long term – 0.71, Medium term – 0.73, Short term – 0.75

Resistance –

- Long term – 0.782, Medium term – 0.78, Short term – 0.78

Economic release today –

- GDP rose 1.1 percent in the fourth quarter, up 2.4 percent from a year ago.

Commentary –

- Latest profit numbers for fourth quarter is suggesting that the mining sector is recovering. The trade balance numbers released this week also suggests the same. These are likely to Aussie supported. Aussie is the best performer of the week so far but down against the dollar.

NZD/USD –

Trading at 0.711

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 0.66, Medium term – 0.69, Short term – 0.69

Resistance –

- Long term – 0.8, Medium term – 0.76, Short term – 0.733

Economic release today –

- RBNZ governor Wheeler is scheduled to speak at 20:00 GMT.

Commentary –

- Kiwi is the worst performer of the day.

USD/CAD –

Trading at 1.333

Trend meter –

- Long term – sell, Medium term – buy, Short term – Range/buy

Support –

- Long term – 1.28, Medium term – 1.3 , Short term – 1.3

Resistance –

- Long term – 1.38, Medium term – 1.365, Short term – 1.365

Economic release today –

- BoC will announce interest rate decision at 15:00 GMT.

Commentary –

- Loonie is the worst performer of the week as the oil slides. The focus is on BoC policy today.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed