Dollar index trading at 103 (-0.07%)

Strength meter (today so far) – Aussie -0.59%, Kiwi -0.36%, Loonie -0.51%

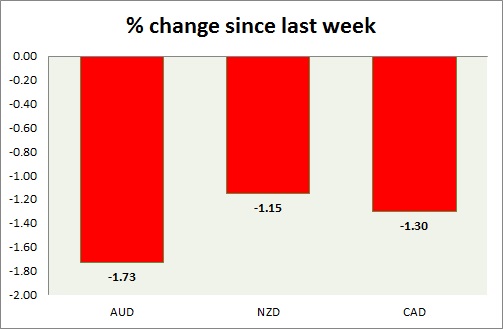

Strength meter (since last week) – Aussie -1.34%, Kiwi -0.96%, Loonie -1.39%

AUD/USD –

Trading at 0.718

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Buy

Support –

- Long term – 0.683, Medium term – 0.72, Short term – 0.73

Resistance –

- Long term – 0.782, Medium term – 0.765, Short term – 0.765

Economic release today –

- NIL

Commentary –

- The Australian dollar is the worst performer of the week so far. Our long call gets wiped out as the stronger dollar weighed more than the gains in commodity prices.

NZD/USD –

Trading at 0.688

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 0.66, Medium term – 0.69 (broken), Short term – 0.69 (broken)

Resistance –

- Long term – 0.8, Medium term – 0.76, Short term – 0.73

Economic release today –

- NIL

Commentary –

- The kiwi still trying to form a base at 0.69 area, decline might extend towards 0.675 area.

USD/CAD –

Trading at 1.35

Trend meter –

- Long term – sell, Medium term – buy, Short term – Range/buy

Support –

- Long term – 1.28, Medium term – 1.3 , Short term – 1.3

Resistance –

- Long term – 1.38, Medium term – 1.365, Short term – 1.365

Economic release today –

- October GDP number will be released at 13:30 GMT.

Commentary –

- Stronger dollar and weaker oil price continues to weigh on the loonie. We expect the loonie to reach 1.375 and 1.4.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX