Dollar index trading at 103.4 (+0.26%)

Strength meter (today so far) – Aussie -0.31%, Kiwi -0.52%, Loonie -0.09%

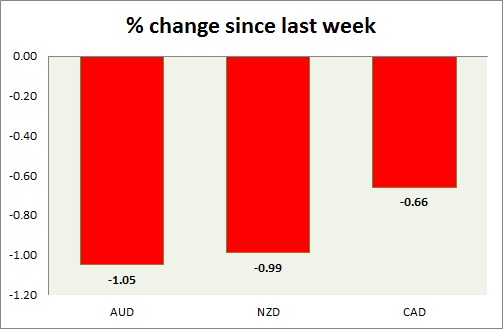

Strength meter (since last week) – Aussie -1.05%, Kiwi -0.99%, Loonie -0.66%

AUD/USD –

Trading at 0.722

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Buy

Support –

- Long term – 0.683, Medium term – 0.72, Short term – 0.73

Resistance –

- Long term – 0.782, Medium term – 0.765, Short term – 0.765

Economic release today –

- NIL

Commentary –

- The Australian dollar has declined to three-month low against the dollar. Active call – Buy AUD/USD at 0.752 and at dip with the stop loss at 0.71 and the target at 0.82

NZD/USD –

Trading at 0.689

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 0.66, Medium term – 0.69 (broken), Short term – 0.69 (broken)

Resistance –

- Long term – 0.8, Medium term – 0.76, Short term – 0.73

Economic release today –

- Global dairy trade auction is scheduled today.

- Trade balance details for November will be published at 21:45 GMT.

Commentary –

- The kiwi breaks 0.69 area, decline might extend towards 0.675 area.

USD/CAD –

Trading at 1.342

Trend meter –

- Long term – sell, Medium term – buy, Short term – Range/buy

Support –

- Long term – 1.28, Medium term – 1.3 , Short term – 1.3

Resistance –

- Long term – 1.38, Medium term – 1.365, Short term – 1.365

Economic release today –

- Wholesale sales report for October will be released at 13:30 GMT.

Commentary –

- Loonie weakens in the face of a stronger dollar. We expect the loonie to reach 1.375 and 1.4.