Dollar index trading at 95.44 (-0.53%)

Strength meter (today so far) - Aussie +0.57%, Kiwi +0.23%, Loonie -0.18%.

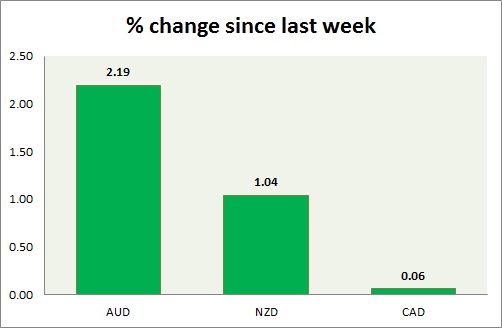

Strength meter (since last week) - Aussie +2.19%, Kiwi +1.04%, Loonie +0.06%.

AUD/USD -

Trading at 0.78

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell Resistance

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.756-0.75

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.793-0.796, Immediate -0.787

Economic release today -

- First quarter GDP grew by 0.9% q/q and 2.3% from a year ago.

Commentary -

- Aussie gained today again as RBA decision continues to provide support amid weaker dollar. Improved first quarter GDP provided the necessary boost. Price is likely to move higher but face sellers around resistance area.

NZD/USD -

Trading at 0.717

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell resistance

Support -

- Long term - 0.653, Medium term - 0.70, Short term - 0.71-0.708

Resistance -

- Long term - 0.883, Medium term - 0.80-0.805, Short term - 0.737-0.74, Immediate - 0.719-0.721

Economic release today -

- NIL

Commentary -

- Kiwi bounced back amid weaker dollar, trading at immediate resistance. Expect selloffs and consolidation as RBNZ meeting approaches.

USD/CAD -

Trading at 1.244

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy Support

Support -

- Long term - 1.17, Medium term - 1.1840-1.18, Short term - 1.217, Immediate - 1.238-1.236

Resistance -

- Long term - 1.298-1.315, Medium term - 1.30-1.35, Short term - 1.28

Economic release today -

- Trade deficit came at $3 billion for May.

Commentary -

- Canadian dollar's performance remained lacklustre this week. Likely to lose further ground against dollar.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary