Dollar index trading at 100.54 (-0.8%)

Strength meter (today so far) – Aussie -0.16%, Kiwi -0.70%, Loonie -0.52%

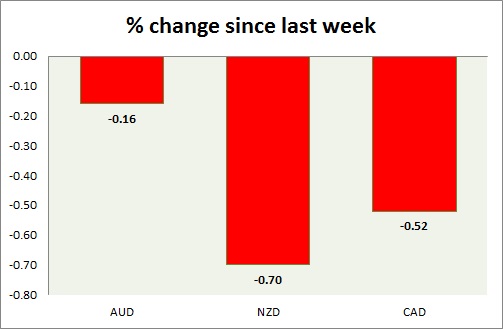

Strength meter (since last week) – Aussie -0.16%, Kiwi -0.70%, Loonie -0.52%

AUD/USD –

Trading at 0.743

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Buy

Support –

- Long term – 0.683, Medium term – 0.72, Short term – 0.73

Resistance –

- Long term – 0.782, Medium term – 0.765, Short term – 0.765

Economic release today –

- TD securities inflation came at 1.5 percent y/y in November.

Commentary –

- The Australian dollar is down as commodities weigh. The focus is on rate decision tomorrow. Active call – Buy AUD/USD at 0.752 and at dip with the stop loss at 0.71 and the target at 0.82

NZD/USD –

Trading at 0.708

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 0.66, Medium term – 0.69, Short term – 0.69

Resistance –

- Long term – 0.8, Medium term – 0.76, Short term – 0.73

Economic release today –

- ANZ commodity prices rose by 2.7 percent in November.

Commentary –

- The kiwi is down as Prime Minister resigns suddenly. We expect kiwi to rise towards 0.81 area.

USD/CAD –

Trading at 1.332

Trend meter –

- Long term – sell, Medium term – buy, Short term – Range/buy

Support –

- Long term – 1.28, Medium term – 1.3 , Short term – 1.32

Resistance –

- Long term – 1.38, Medium term – 1.365, Short term – 1.365

Economic release today –

- NIL

Commentary –

- Loonie is down more than half a percent despite gains in oil price. We expect the loonie to reach 1.375 and 1.4.