Dollar index trading at 97.54 (+0.33%).

Strength meter (today so far) - Aussie -0.38%, Kiwi -0.09%, Loonie -0.25%.

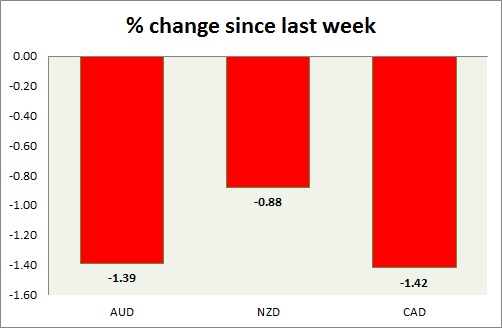

Strength meter (since last week) - Aussie -1.39%, Kiwi -0.88%, Loonie -1.42%.

AUD/USD -

Trading at 0.772

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell Resistance

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.756-0.75, Immediate - 0.77-0.768

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.793-0.796, Immediate -0.787

Economic release today -

- Westpac leading index grew by 0.1% in April.

- Construction work done fell by -2.4% in the first quarter.

Commentary -

- Aussie is once again the worst performer today among commodity pairs. Further drop is likely, however price has reached immediate support area. Bounce back or consolidation might take place before further selloffs.

NZD/USD -

Trading at 0.725

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell resistance

Support -

- Long term - 0.653, Medium term - 0.719-0.712, Short term - 0.72

Resistance -

- Long term - 0.883, Medium term - 0.80-0.805, Short term - 0.768-0.772, Immediate - 0.74

Economic release today -

- NIL

Commentary -

- Kiwi selloffs slowed down as price is approaching crucial support area. Kiwi might consolidate here with downside bias. Support area of 0.72-0.712 is crucial.

USD/CAD -

Trading at 1.244

Trend meter -

- Long term - Buy, Medium term - Range/Sell, Short term - Range/Buy Support

Support -

- Long term - 1.17, Medium term - 1.1840-1.18, Short term - 1.217

Resistance -

- Long term - 1.298-1.315, Medium term - 1.30-1.35, Short term - 1.235-1.241

Economic release today -

- Bank of Canada held policy steady.

Commentary -

- Canadian dollar is expected to lose further against dollar. Target is coming around 1.285-1.29.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings