Dollar index trading at 97.76 (+0.01%)

Strength meter (today so far) – Aussie -0.30%, Kiwi -0.15%, Loonie +0.02%

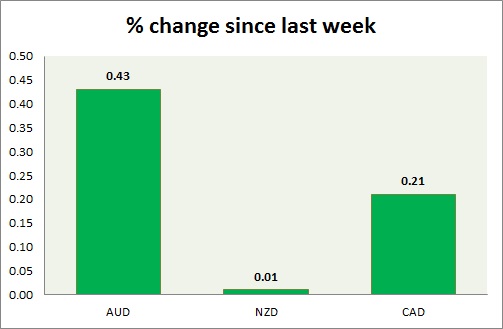

Strength meter (since last week) – Aussie +0.43%, Kiwi +0.01%, Loonie +0.21%

AUD/USD –

Trading at 0.769

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Buy

Support –

- Long term – 0.683, Medium term – 0.72, Short term – 0.73

Resistance –

- Long term – 0.782, Medium term – 0.765, Short term – 0.765

Economic release today –

- National Australia Bank’s business confidence declined to 4 from 6. Business conditions declined to 6 from 8.

Commentary –

- The Australian dollar continues to test key resistance. Active call – Buy AUD/USD at 0.752 and at dip with the stop loss at 0.71 and the target at 0.82

NZD/USD –

Trading at 0.732

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 0.66, Medium term – 0.69, Short term – 0.69

Resistance –

- Long term – 0.8, Medium term – 0.76, Short term – 0.73

Economic release today –

- Electric card retail sales will be released at 21:45 GMT.

Commentary –

- The kiwi is the worst performer of the week. We expect kiwi to rise towards 0.81 area.

USD/CAD –

Trading at 1.337

Trend meter –

- Long term – sell, Medium term – buy, Short term – Range/buy

Support –

- Long term – 1.248, Medium term – 1.25 , Short term – 1.25

Resistance –

- Long term – 1.38, Medium term – 1.345, Short term – 1.345

Economic release today –

- NIL

Commentary –

- The Canadian dollar is almost flat for the day. We expect the loonie to reach 1.375 and 1.4.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022