Dollar index trading at 95.37 (+1.29%).

Strength meter (today so far) - Aussie -1.02%, Kiwi -0.42%, Loonie -0.73%.

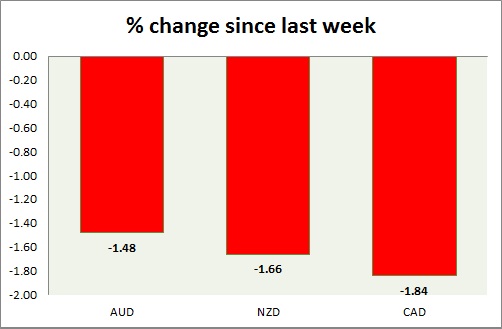

Strength meter (since last week) - Aussie -1.48%, Kiwi -1.66%, Loonie -1.84%.

AUD/USD -

Trading at 0.791

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Buy support

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.756-0.75, Immediate - 0.786-0.784

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.83

Economic release today -

- CB leading indicator dropped by -0.1% in March.

Commentary -

- Aussie dropped further as dollar gained from four month low. However sell is not recommended as of now. Aussie is losing in on key support.

NZD/USD -

Trading at 0.734

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell resistance

Support -

- Long term - 0.653, Medium term - 0.719-0.712, Short term - 0.738-0.736

Resistance -

- Long term - 0.883, Medium term - 0.80-0.805, Short term - 0.768-0.772, Immediate - 0.748-0.752

Economic release today -

- Inflation expectation rose marginally to 1.85% for second quarter.

Commentary -

- Kiwi is losing ground and broken below short term support area. Some bounce back might occur, however further downside remains open should dollar strengthen further.

USD/CAD -

Trading at 1.222

Trend meter -

- Long term - Buy, Medium term - Range/Sell, Short term - Range

Support -

- Long term - 1.17, Medium term - 1.1840-1.18, Short term - 1.19

Resistance -

- Long term - 1.298-1.315, Medium term - 1.30-1.35, Short term - 1.235-1.241, Immediate - 1.225-1.228

Economic release today -

- BOC governor Poloz is scheduled to speak at 15:45 GMT.

Commentary -

- Canadian dollar bulls gave up further gains as dollar strengthened and oil weakened. Pair is testing immediate resistance.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?