Dollar index trading at 97.91 (+0.06%)

Strength meter (today so far) – Aussie -0.75%, Kiwi -0.05%, Loonie -0.26%

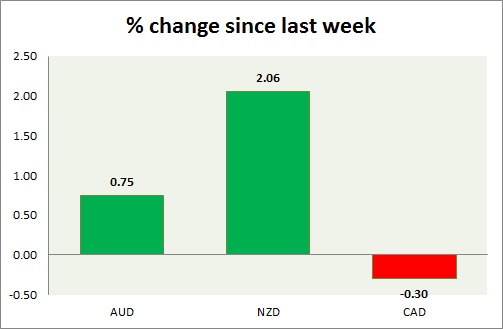

Strength meter (since last week) – Aussie +0.75%, Kiwi +2.06%, Loonie -0.30%

AUD/USD –

Trading at 0.767

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Buy

Support –

- Long term – 0.683, Medium term – 0.72, Short term – 0.73

Resistance –

- Long term – 0.782, Medium term – 0.765, Short term – 0.765

Economic release today –

- The full time employment declined by 53,000 and part time employment rose by 43,200.

- Unemployment rose by 5.6 percent.

- National Bank’s business confidence rose to 5 in the third quarter.

Commentary –

- The Australian dollar continues to struggle below key resistance. Active call – Buy AUD/USD at 0.752 and at dip with the stop loss at 0.71 and the target at 0.82

NZD/USD –

Trading at 0.723

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 0.66, Medium term – 0.69, Short term – 0.69

Resistance –

- Long term – 0.8, Medium term – 0.76, Short term – 0.73

Economic release today –

- NIL

Commentary –

- The kiwi remains the best performer of the week so far. We expect kiwi to rise towards 0.81 area.

USD/CAD –

Trading at 1.317

Trend meter –

- Long term – sell, Medium term – buy, Short term – Range/buy

Support –

- Long term – 1.248, Medium term – 1.25 , Short term – 1.25

Resistance –

- Long term – 1.34, Medium term – 1.325, Short term – 1.325

Economic release today –

- NIL

Commentary –

- The Canadian dollar’s performance waned as the oil price decline adds pressure. It remains as the worst performer of the week.