Dollar index trading at 97.76 (-0.10%)

Strength meter (today so far) – Aussie +0.45%, Kiwi +0.58%, Loonie +0.07%

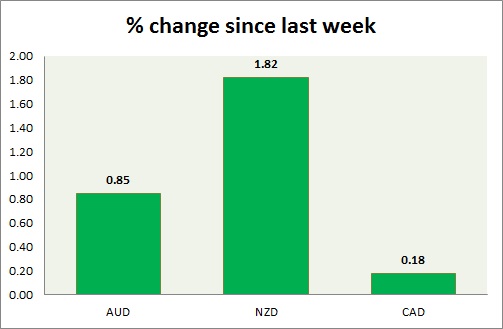

Strength meter (since last week) – Aussie +0.85%, Kiwi +1.82%, Loonie +0.18%

AUD/USD –

Trading at 0.767

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Buy

Support –

- Long term – 0.683, Medium term – 0.72, Short term – 0.73

Resistance –

- Long term – 0.782, Medium term – 0.765, Short term – 0.765

Economic release today –

- New motor vehicle sales rose by 2.5 percent y/y.

Commentary –

- The Australian dollar is slowly regaining its mojo again. Active call – Buy AUD/USD at 0.752 and at dip with the stop loss at 0.71 and the target at 0.82

NZD/USD –

Trading at 0.721

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 0.66, Medium term – 0.69, Short term – 0.69

Resistance –

- Long term – 0.8, Medium term – 0.76, Short term – 0.73

Economic release today –

- Third quarter CPI data will be released at 22:45 GMT.

Commentary –

- The kiwi is the best performer of the week so far. We expect kiwi to rise towards 0.81 area.

USD/CAD –

Trading at 1.31

Trend meter –

- Long term – sell, Medium term – buy, Short term – Range/buy

Support –

- Long term – 1.248, Medium term – 1.25 , Short term – 1.25

Resistance –

- Long term – 1.34, Medium term – 1.325, Short term – 1.325

Economic release today –

- Manufacturing shipments grew 0.9 percent.

Commentary –

- The Canadian dollar is the worst performer of the week.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX