Dollar index trading at 97.98 (-0.01%).

Strength meter (today so far) - Aussie +0.73%, Kiwi +0.07%, Loonie +0.33%.

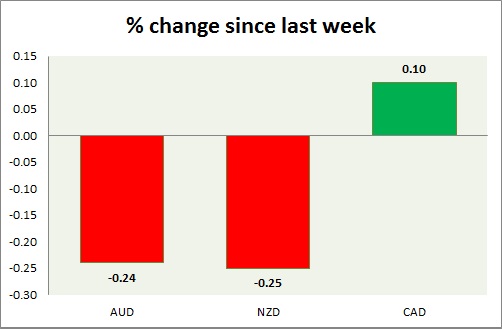

Strength meter (since last week) - Aussie -0.24%, Kiwi -0.25%, Loonie +0.10%.

AUD/USD -

Trading at 0.776

Trend meter -

- Long term - Sell, Medium term - Sell, Short term - Range/Sell Resistance

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.756-0.75

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.79-0.80

Economic release today -

- RBA trimmed mean CPI improved to 2.3% y/y in 1st quarter.

- Westpac leading index dropped -0.3% in March.

Commentary -

- Aussie got a boost from improved CPI, however rallies continue face heavy selling pressure, whenever dollar strengthens broad-based. Bulls failed to pose any major advance above 0.78.

NZD/USD -

Trading at 0.767

Trend meter -

- Long term - Sell, Medium term - Buy/Range, Short term - Range

Support -

- Long term - 0.653, Medium term - 0.719-0.712, Short term - 0.738-0.736, Immediate - 0.744-0.741

Resistance -

- Long term - 0.883, Medium term - 0.80-0.805, Short term - 0.768-0.772

Economic release today -

- NIL

Commentary -

- Kiwi's is showing improved strength, however rallies are facing strong selling pressure above 0.77 area. However bulls might advance in coming days to test 0.79-0.80 area.

USD/CAD -

Trading at 1.223

Trend meter -

- Long term - Buy, Medium term - Range/Sell, Short term - Range/Sell

Support -

- Long term - 1.17, Medium term - 1.1840-1.18, Short term - 1.205-1.20

Resistance -

- Long term - 1.298-1.315, Medium term - 1.30-1.35, Short term - 1.267-1.27. Immediate - 1.235-1.241

Economic release today -

- NIL

Commentary -

- Loonie's performance waned this week, as CAD bulls are struggling to gain amid weaker oil price after last week's break. Pair maintains high correlation with oil.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?