Dollar index trading at 95.74 (-0.40%)

Strength meter (today so far) – Aussie +0.72%, Kiwi +0.90%, Loonie +0.47%

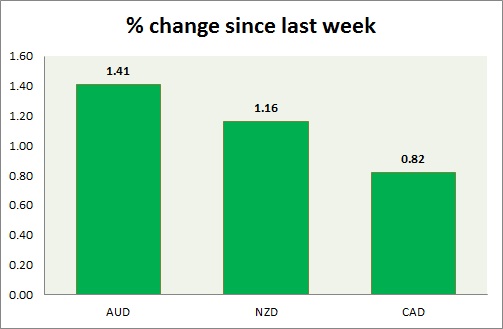

Strength meter (since last week) – Aussie +1.41%, Kiwi +1.16%, Loonie +0.82%

AUD/USD –

Trading at 0.772

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Range

Support –

- Long term – 0.683, Medium term – 0.72, Short term – 0.73

Resistance –

- Long term – 0.782, Medium term – 0.765, Short term – 0.765

Economic release today –

- Westpac consumer confidence grew 2 percent in August.

- Home loans rose 1.2 percent in June.

- Investment lending for homes rose 3.2 percent.

Commentary –

- Aussie is the best performer for the week. Active call – Buy AUD/USD at 0.752 and at dip with the stop loss at 0.71 and the target at 0.82

NZD/USD –

Trading at 0.723

Trend meter –

- Long term – Sell, Medium term – Range, Short term – range

Support –

- Long term – 0.66, Medium term – 0.69, Short term – 0.69

Resistance –

- Long term – 0.8, Medium term – 0.76, Short term – 0.73

Economic release today –

- RBNZ will announce monetary policy decision at 21:00 GMT.

- Food price index data will be released at 22:45 GMT.

Commentary –

- Expectations of further easing from RBNZ continue to weigh on the kiwi but trading strong despite pricing of the 25 basis points.

USD/CAD –

Trading at 1.305

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range

Support –

- Long term – 1.248, Medium term – 1.25 , Short term – 1.25

Resistance –

- Long term – 1.34, Medium term – 1.325, Short term – 1.325

Economic release today –

- NIL

Commentary –

- Canadian dollar’s performance improved after surprise OPEC meeting next month.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX